Little pieces of paper, like the humble rent receipt, can be important in our daily lives. Whether in a cozy apartment or a charming house, rent receipts are crucial to your financial journey. They are like friendly notes confirming the rent payment, creating a sense of security and clarity between tenants and landlords.

Ever wondered about the magic behind these slips of paper? We’re here to solve the mystery and make your life easier! Welcome to a world where creating a rent receipt online becomes a breeze. We understand that not everyone is a financial wizard, and that’s perfectly okay. Our guide is designed to be as simple as ABC, so easy that anyone can quickly grasp it.

In this guide, we’ll take you on a journey to discover the ins and outs of rent receipts – why they matter, how they benefit you, and, most importantly, how to craft one effortlessly online. We do not need complicated tricks or confusing steps; we’ve got your back. So, buckle up and prepare to make your financial life much smoother by creating rent receipts online!

What is a Rent Receipt?

A rent receipt is a piece of paper that proves you’ve paid your rent. It’s like a friendly note between you and your landlord, showing you’ve given them the money you owe for living in your home. This receipt is necessary because it acts as a record, stating the amount of rent you paid, when you paid it, and for which period.

It includes details like your name, your landlord’s name, the amount paid, the duration it covers, and your home’s address. This little document is not just a formality; it’s a useful tool. It helps you keep track of your payments, proves you’ve met your financial responsibilities, and sometimes, it can even help you with taxes. So, holding on to your rent receipt is a good habit for a smooth and worry-free living arrangement.

Why are rent receipts required?

Rent receipts are significant in the relationship between tenants and landlords. They prove that the tenant has paid their rent, making a detailed transaction record. This is good because it clarifies everything and builds trust between the tenant and landlord.

Moreover, rent receipts are instrumental in claiming House Rent Allowance (HRA) exemptions under Section 10 (13A) of the Income Tax Act. Employers often require these receipts to verify rent payments and provide eligible deductions and allowances. The HRA allowance is intricately linked to the information provided in these receipts, influencing the calculation of exemptions.

Apart from money matters, rent receipts help landlords and tenants keep good records of rent payments. This is useful for planning finances, budgeting, and meeting tax obligations. They also protect people legally by showing proof of payment if there are any problems with rent. Ultimately, they ensure renters follow the rules in the rental agreement, making renting a home a smooth and responsible experience for everyone involved.

What is the tax benefit of monthly rent paid?

When structured appropriately, rent payments offer tax benefits for individuals living in rented accommodations. Salaried professionals residing in rented houses can leverage the House Rent Allowance (HRA) exemption under Section 10 (13A) of the Income Tax Act. Meanwhile, self-employed individuals can avail of HRA tax deduction under Section 80GG.

To calculate the HRA-exempted amount, you can follow these steps:

1. Actual HRA Received: Begin with your employer’s actual House Rent Allowance.

2. Rent Paid – 10% of Basic Salary & Dearness Allowance: Deduct 10% of your basic salary and dearness allowance from the rent you pay.

3. Metro City vs. Non-Metro City Calculation: If you reside in a metro city, consider 50% of your basic salary and dearness allowance; for non-metro cities, it is 40%. Choose the lowest value among these three components.

The amount you get from these calculations is the HRA exemption, which affects how much tax you must pay. These calculations ensure that people get the proper exemptions for their rent, which can help save on taxes. It’s like saying thank you to people for spending money on their homes, making money matters easier, and encouraging people to rent homes.

Essential Components of Rent Receipt

A rent receipt is a critical document for tenants and landlords, providing a clear record of financial transactions. To ensure its completeness and legality, a rent receipt should contain the following essential components:

1. Tenant Name: Clearly state the tenant’s full name, ensuring accurate identification.

2. Landlord Name: For proper documentation, include the landlord’s full name.

3. Rent Paid: Specify the exact amount of rent paid by the tenant for the specified period.

4. Rental Period: Mention the duration the rent payment covers, whether monthly, quarterly, or annually.

5. House Address: Include the complete address of the rented property, including details like the unit number or floor, if applicable.

6. Signature of Landlord: Ensure that the landlord provides a signature on the receipt, adding authenticity to the document.

7. PAN of the Landlord (if your annual rent exceeds Rs. 1,00,000): If the annual rent paid by the tenant exceeds Rs. 1,00,000, it is crucial to include the Permanent Account Number (PAN) of the landlord for tax compliance.

Including these components in the rent receipt creates a comprehensive and legally sound document. It provides evidence of the rent payment and facilitates a smooth landlord-tenant relationship by promoting transparency and accountability in financial transactions.

How to Create Rent Receipts Online?

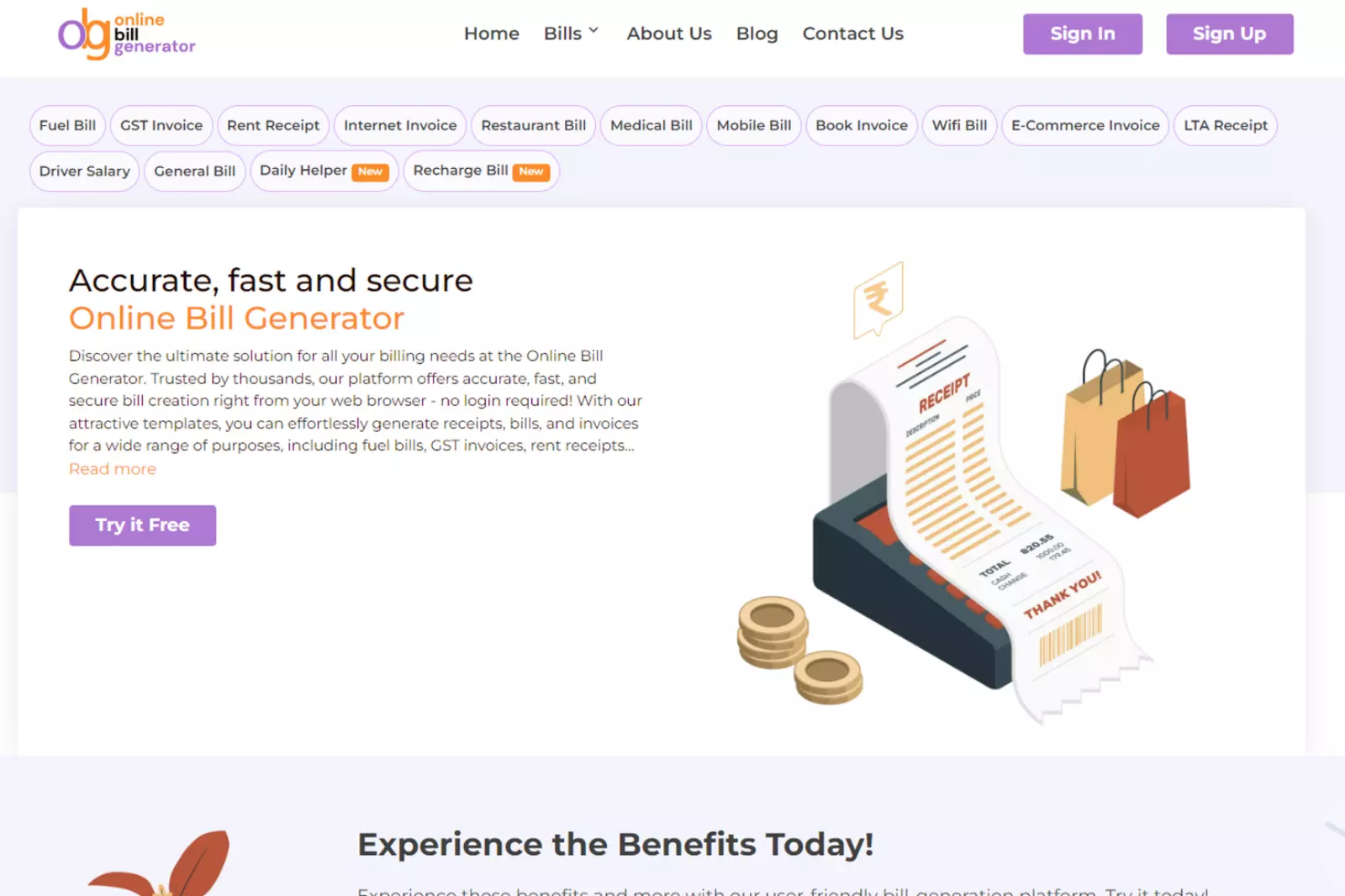

Creating rent receipts online has become convenient and efficient, simplifying the documentation of financial transactions between tenants and landlords. One user-friendly platform for this purpose is billgenerator.online. Follow these straightforward steps to generate a rent receipt using this platform:

1. Visit the Site: Open your web browser and go to https://billgenerator.online.

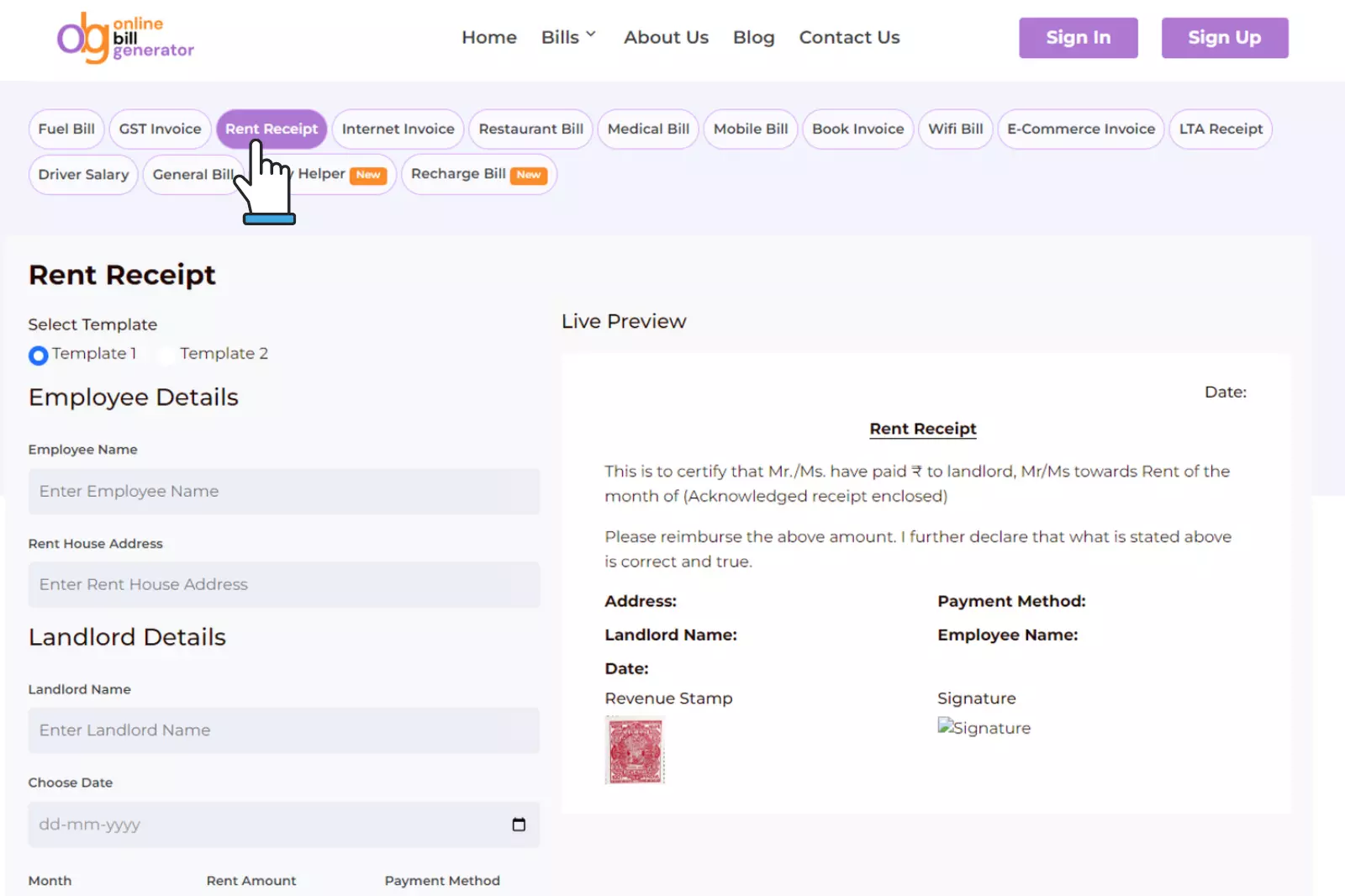

2. Click on Rent Receipt: On the website’s homepage, locate and click on the option specifically for “Rent Receipt.”

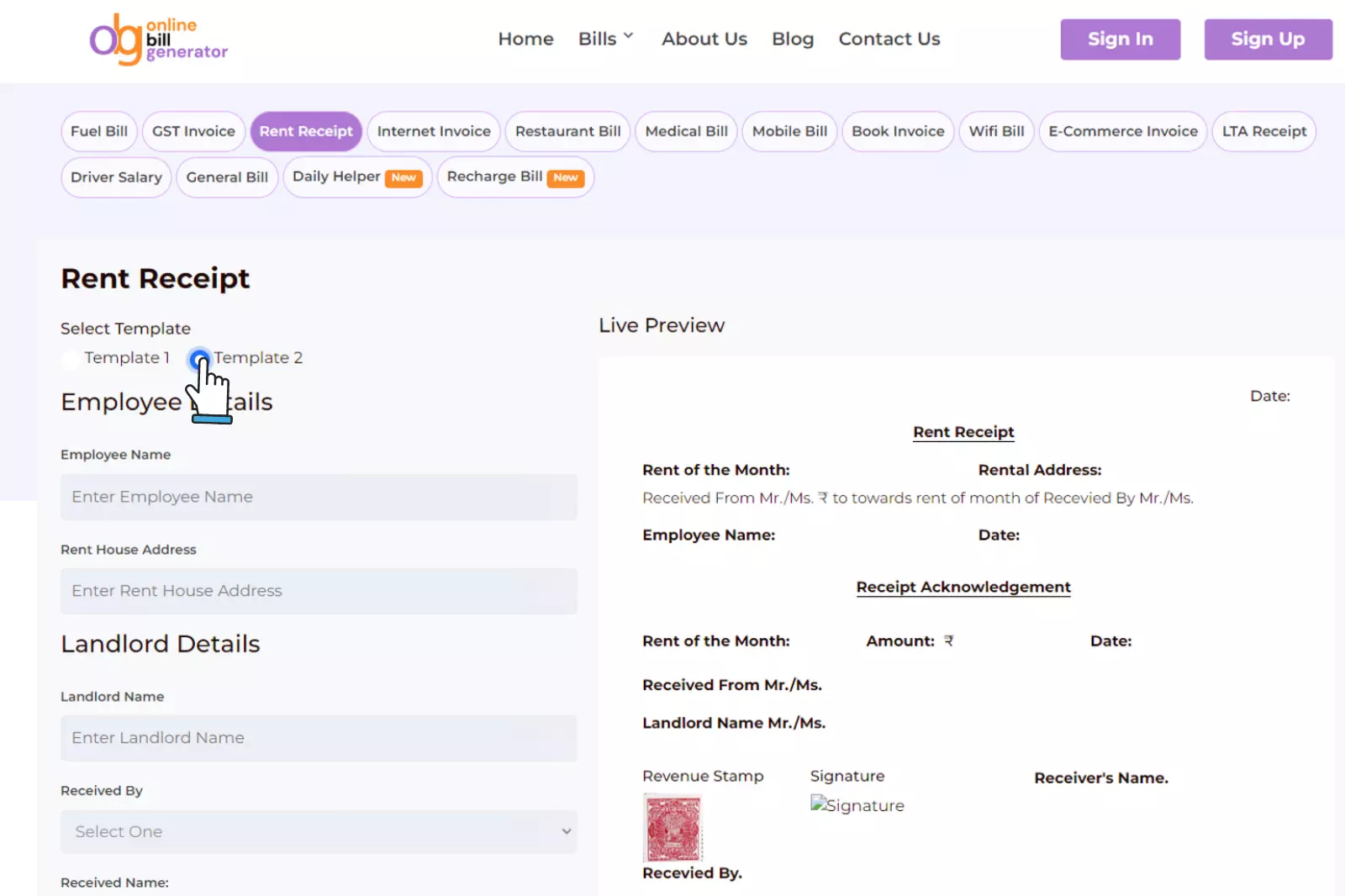

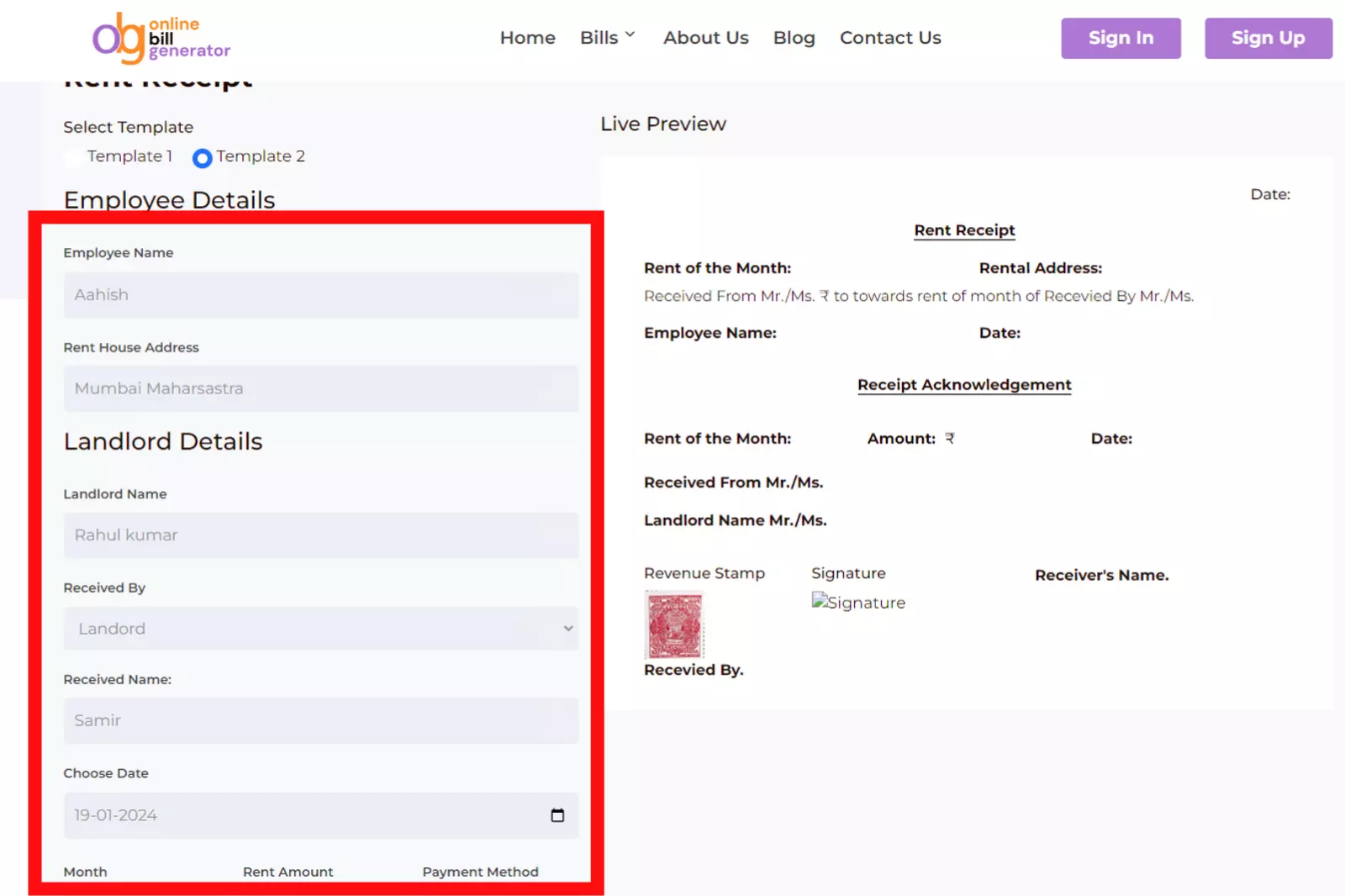

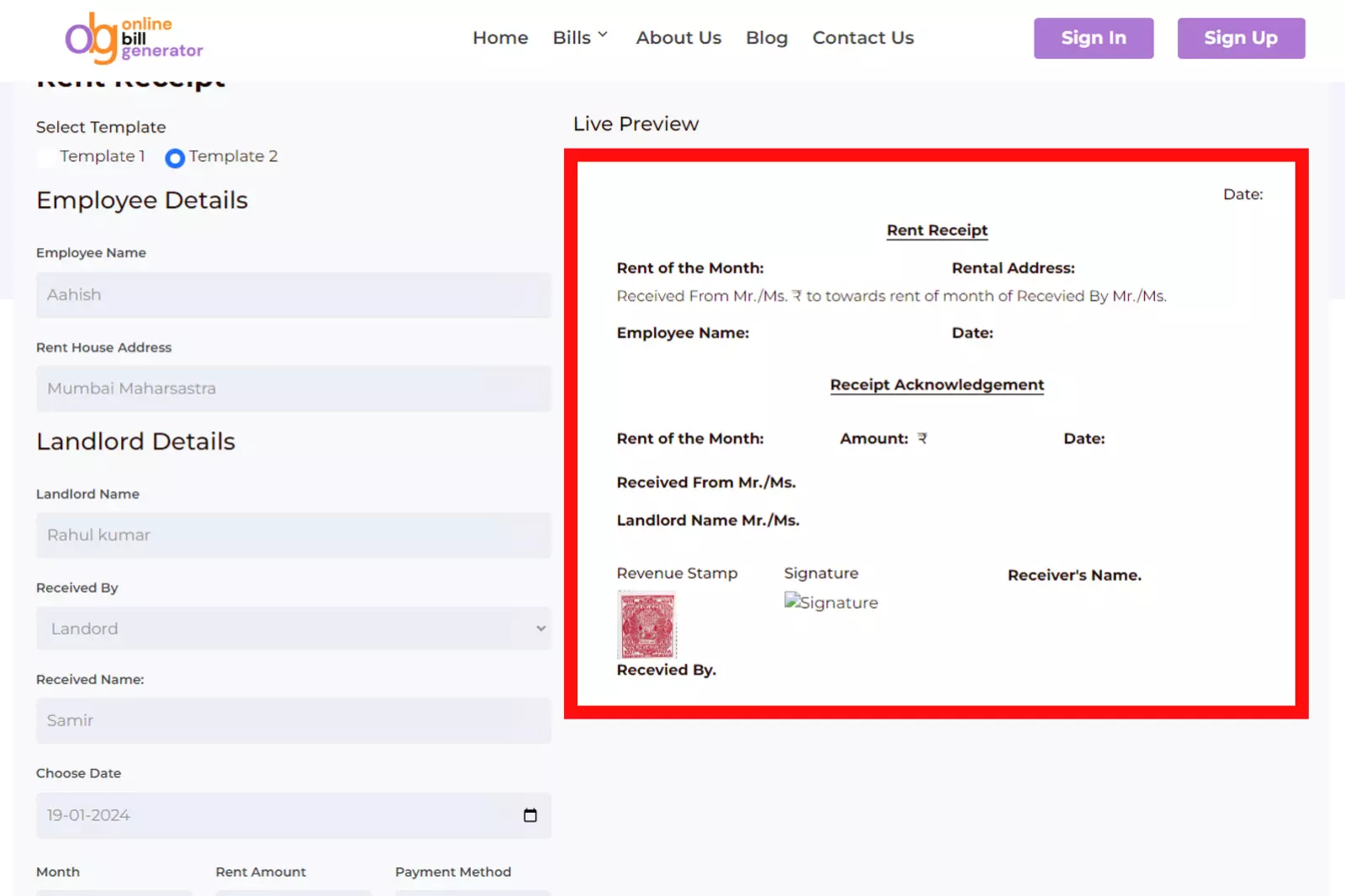

3. Select the Template You Want: Choose a suitable template from the available options that best fits your preferences or requirements.

4. Fill Accurate Details: Enter the necessary details, including the tenant’s name, landlord’s name, rent amount, rental period, house address, and other relevant information. Ensure accuracy for a comprehensive record.

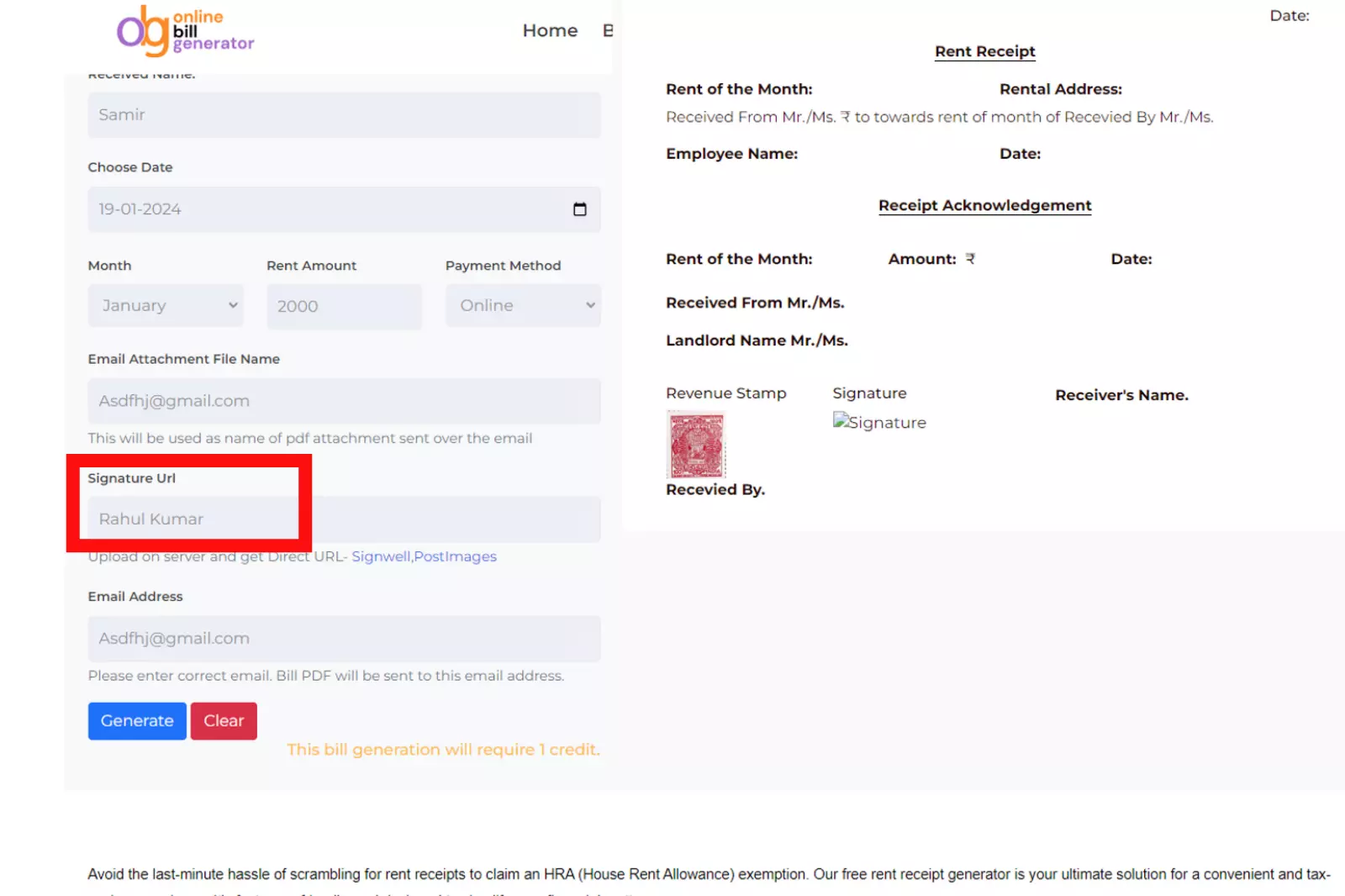

5. Upload the Signature URL: If required, upload the signature URL. This step adds a personal touch to the receipt and enhances its authenticity.

6. Preview the Receipt: After filling in all the details, take a moment to preview the receipt. The platform typically provides a preview on the right side of the screen, allowing you to double-check the information.

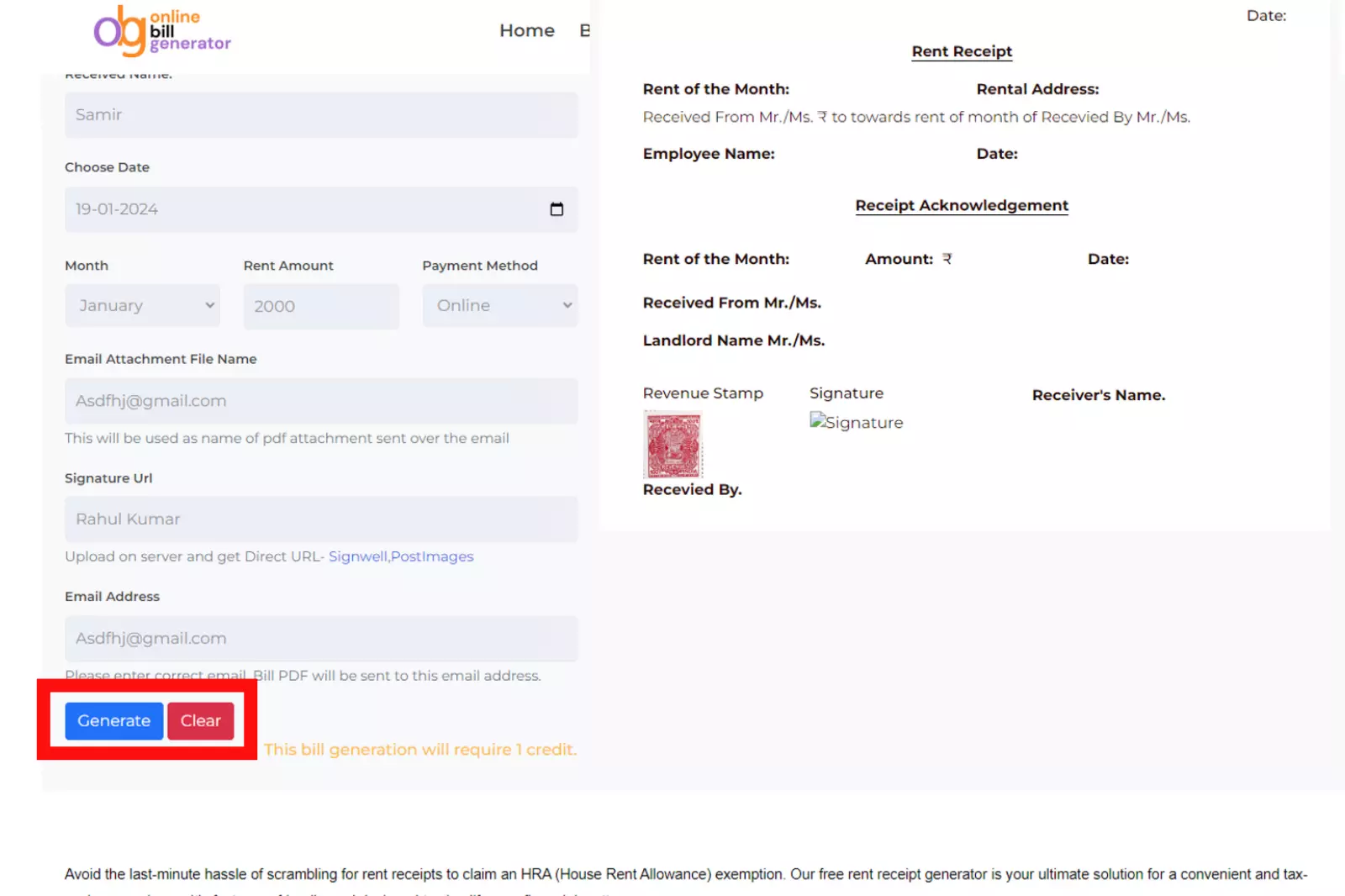

7. Click on Generate: Once satisfied with the preview and verified all details, click on the “Generate” button. This action prompts the platform to compile the information and generate the rent receipt in a downloadable PDF format.

8. Download Receipt as PDF: The final step involves downloading the generated receipt. Click on the provided download link or button to save the rent receipt to your device in PDF format.

By following these user-friendly steps on billgenerator.online, you can swiftly create a professional and accurate rent receipt online, streamlining the process for both tenants and landlords.

Important points to remember while generating Rent Receipt

Generating rent receipts is crucial to maintaining transparent and accountable financial transactions between tenants and landlords. Here are essential points to remember while generating rent receipts, particularly when opting for an online approach:

1. Online Payment for Transparency

Opt for online rent payment rather than offline methods. This ensures a transparent and easily accessible record of transactions, promoting clarity for tenants and landlords.

2. Valid Rent Agreement

Ensure a valid rent agreement covers all essential details, such as monthly rent, the agreement period, and arrangements for utility bills. This becomes especially crucial in shared accommodations where multiple individuals may be involved.

3. Receipt with Revenue Stamp:

Include a revenue stamp on the rent receipt to ensure its validity for tax purposes. This is particularly important when claiming House Rent Allowance (HRA) exemptions for monthly rent paid above ₹3,000. Share the receipt with your employer for verification.

4. Annual Rent Payment Exceeds Rs. 1 Lakh:

If your annual rent payment exceeds Rs. 1 lakh, provide your landlord’s PAN (Permanent Account Number). This is essential for tax compliance and reporting.

5. PAN Unavailable:

If the landlord does not have a PAN, they must provide a declaration confirming it. Additionally, they should fill and submit ‘Form 60’ to the employer to meet tax requirements.

6. Higher Rent Payments Than Agreement:

If you pay a higher amount than what is mentioned in the rent agreement, ensure that the rent receipt reflects the actual amount paid. Tax exemption is calculated based on the rent receipt, making accuracy crucial for financial planning.

By sticking to these critical points, tenants can create rent receipts that are not only legally sound but also facilitate a smooth process for claiming HRA exemptions and maintaining a transparent financial record.

10 Best Tools to Create Rent Receipts Online

1. billgenerator.online

Online Bill Generator is the best online rent receipt generator, combining an intuitive user interface with unparalleled functionality. Its user-friendly design ensures a seamless experience, allowing users to input details and generate precise rent receipts effortlessly.

Its versatility sets it apart – it’s not just a rent receipt generator but a comprehensive platform offering a range of features. From fuel bills and internet invoices to restaurant, medical, book, and general bills, Online Bill Generator excels in providing an all-in-one solution for diverse billing needs. Its robust functionality and user-centric design make it the top choice for those seeking an efficient online bill-generation experience.

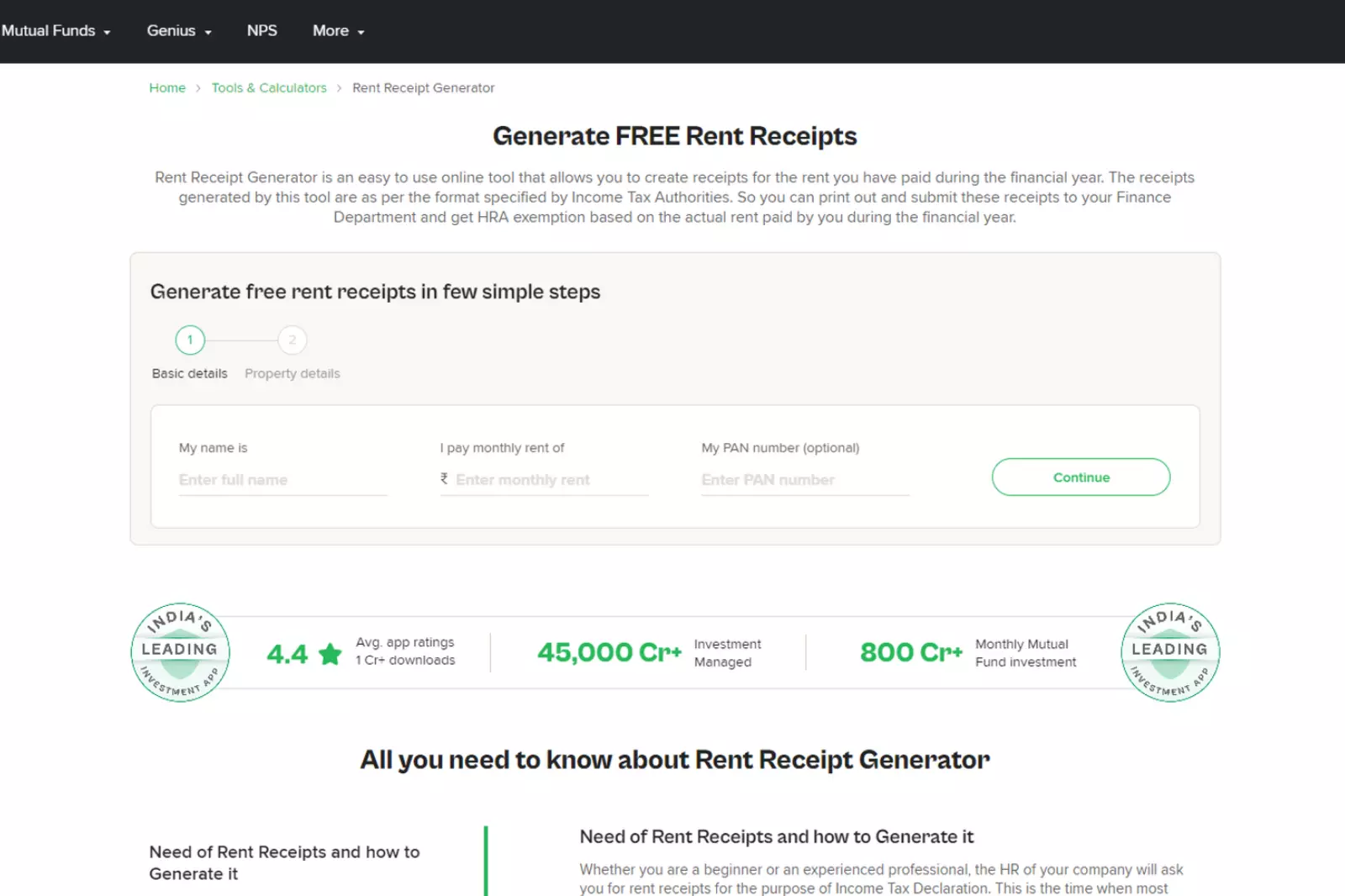

2. ET Money

ET Money’s online house rent receipt generator offers a hassle-free experience, simplifying the creation of accurate and detailed receipts. The user-friendly platform ensures transparency in financial transactions, making it an ideal choice for those seeking simplicity in their documentation.

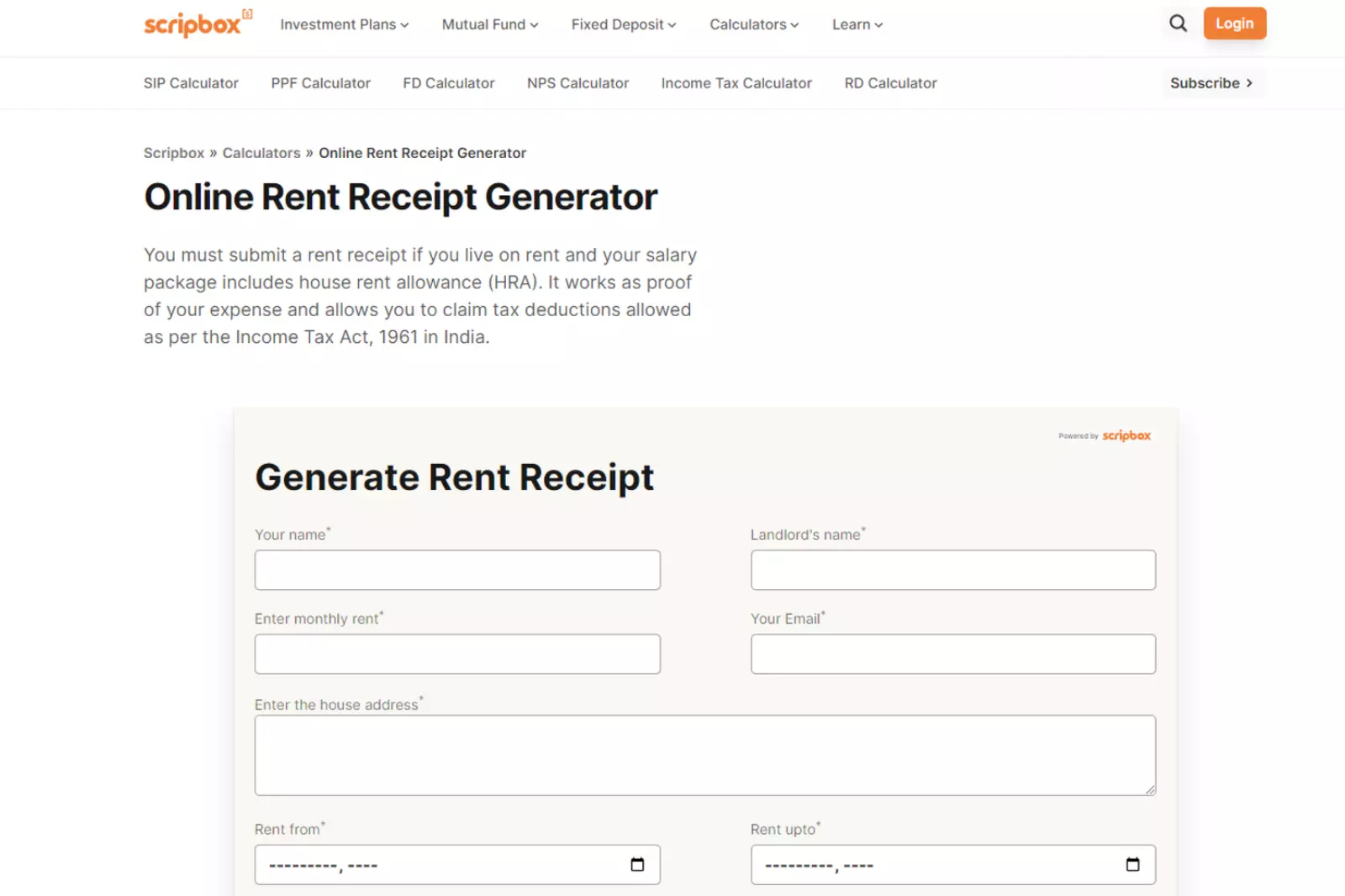

3. Scripbox

Scripbox transforms the process of generating house rent receipts into a delightful experience. Its intuitive platform ensures users can effortlessly input details, creating professionally crafted receipts. Enjoy a user-centric approach that simplifies financial record-keeping.

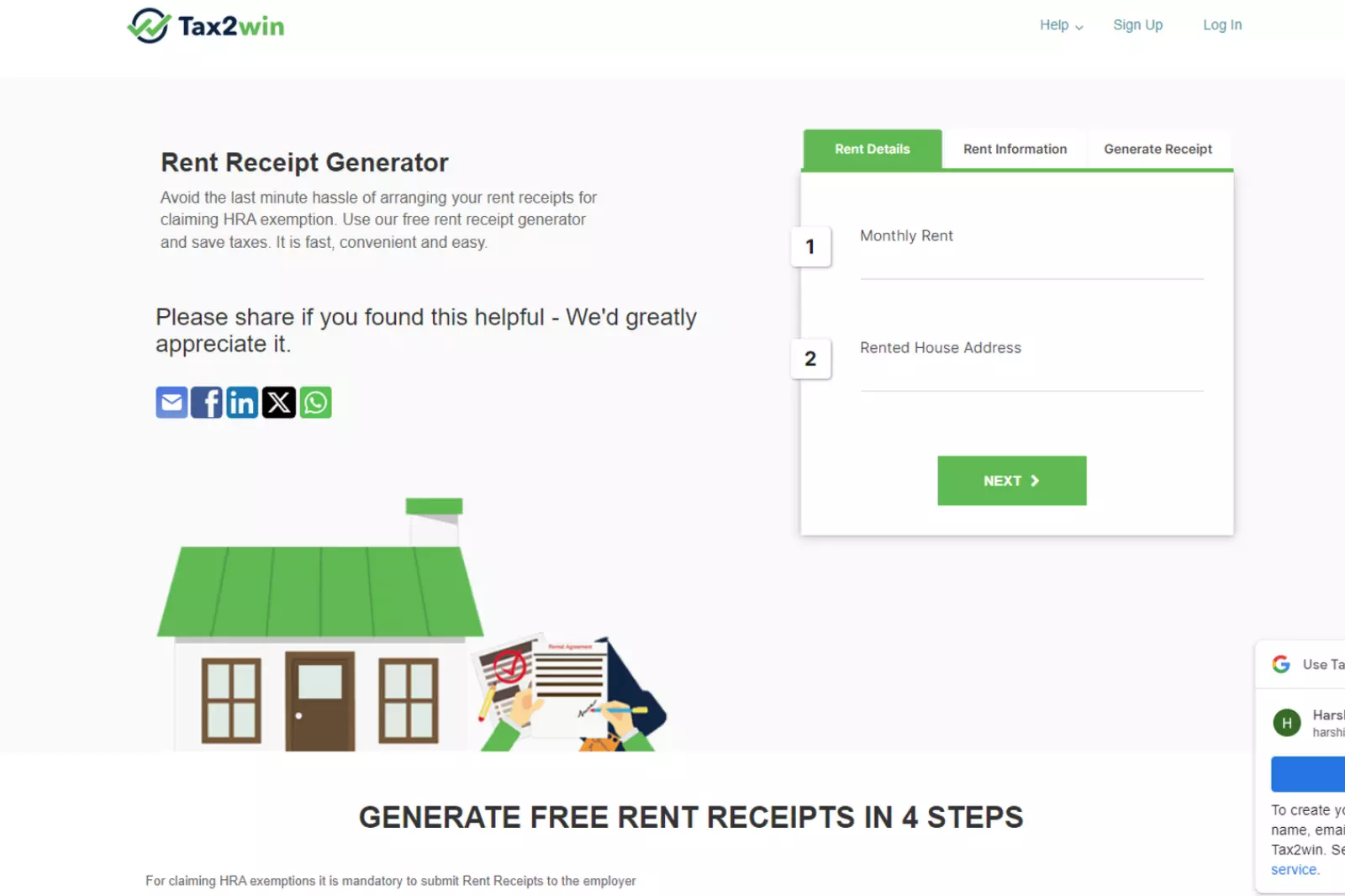

4. Tax2win

Navigate tax compliance effortlessly with Tax2win’s online house rent receipt generator. Craft precise and compliant receipts for claiming HRA exemptions and experience simplicity in tax-related documentation.

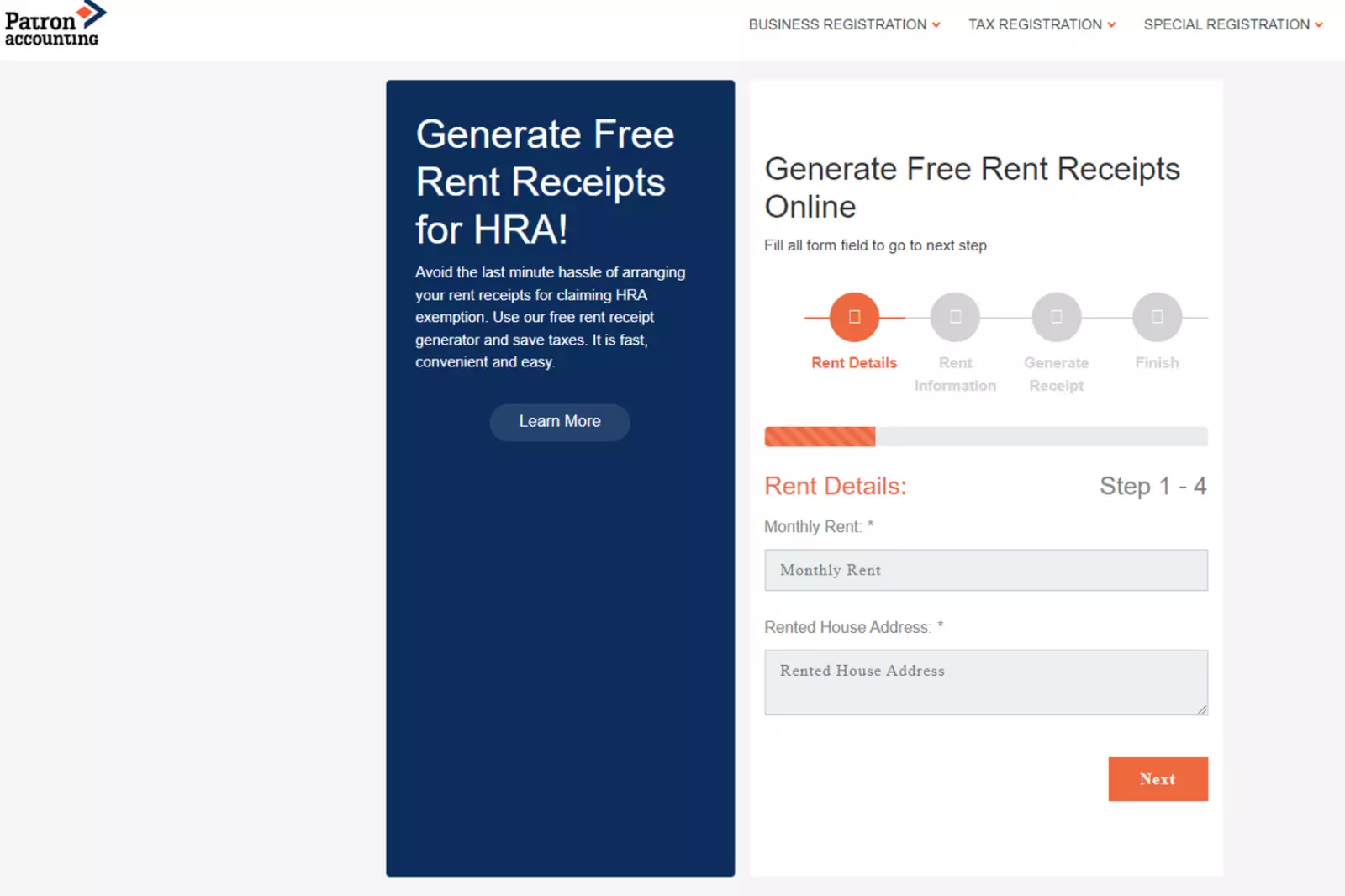

5. Patron Accounting

Patron Accounting redefines house rent receipt generation, offering a seamless and user-friendly platform. Easily input details and generate professional receipts for transparent financial records. It’s a user-centric solution for efficient financial management.

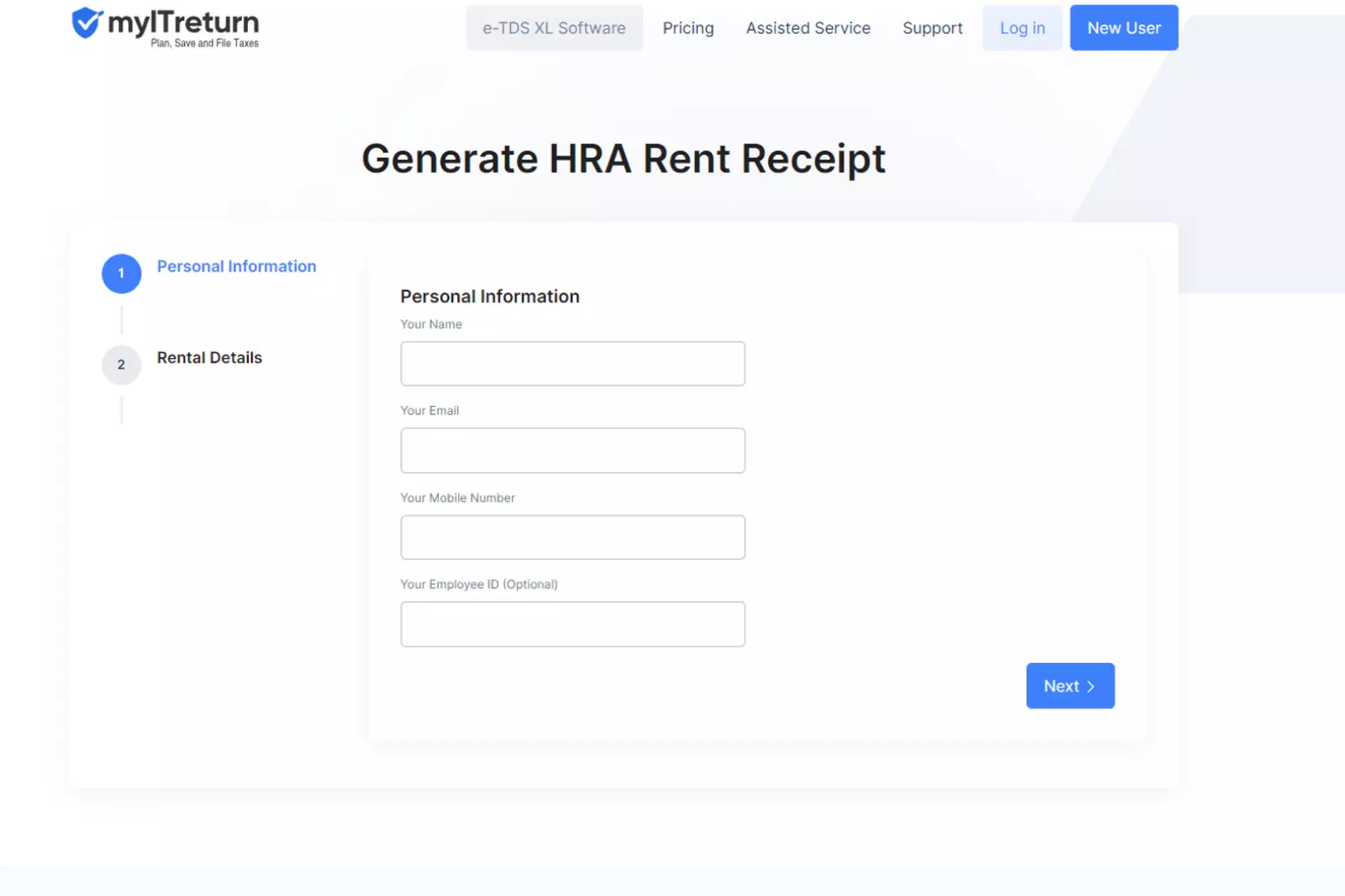

6. myitreturn

Elevate your tax documentation with myitreturn’s online house rent receipt generator. Create accurate receipts effortlessly, ensuring compliance with tax regulations. It’s a user-friendly platform designed to simplify financial record-keeping.

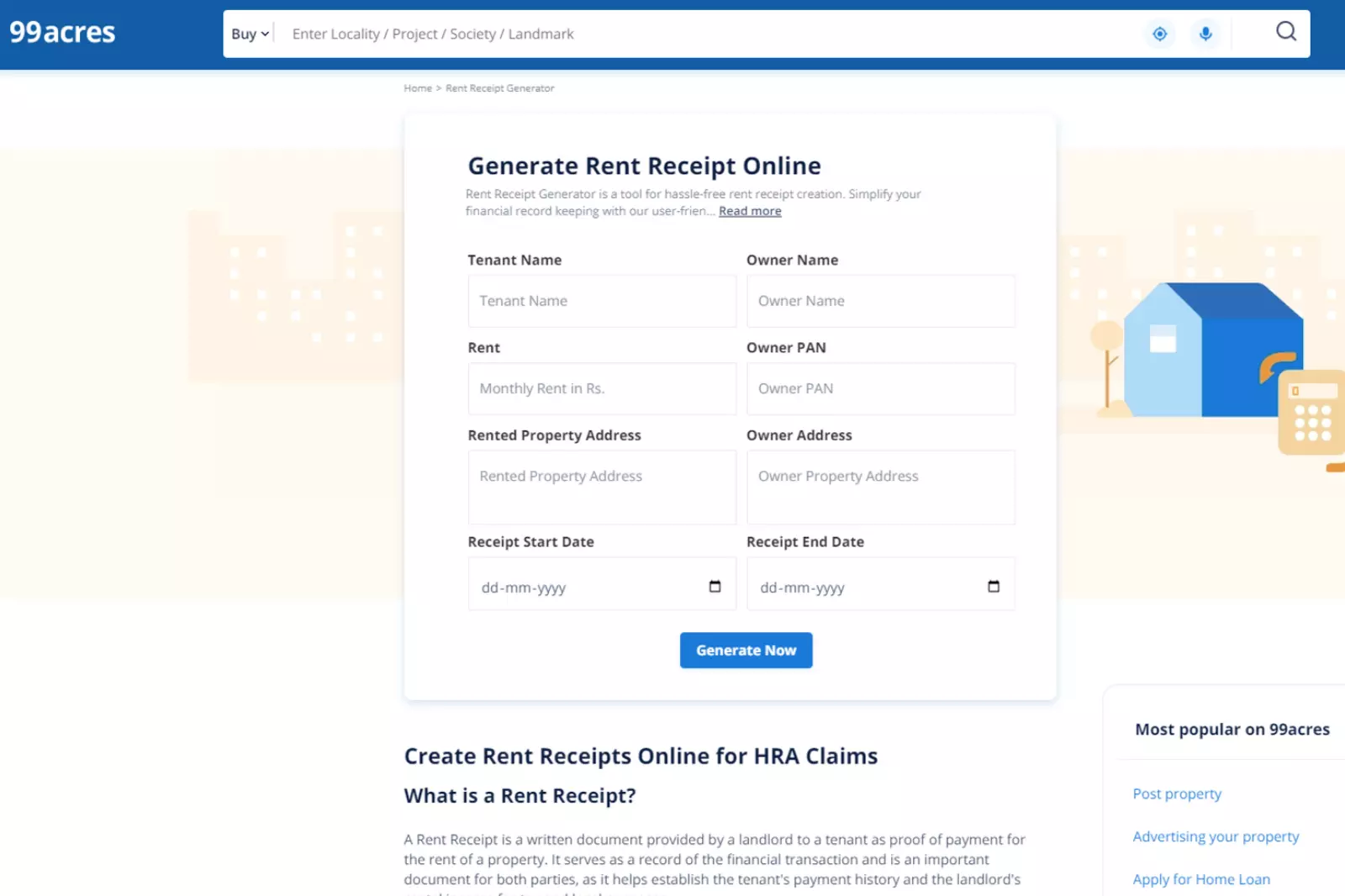

7. 99acres

Empower your rental transactions with 99acres’ online house rent receipt generator. Craft detailed and accurate receipts seamlessly to maintain transparent financial records. Explore the user-friendly features tailored to enhance your overall financial experience.

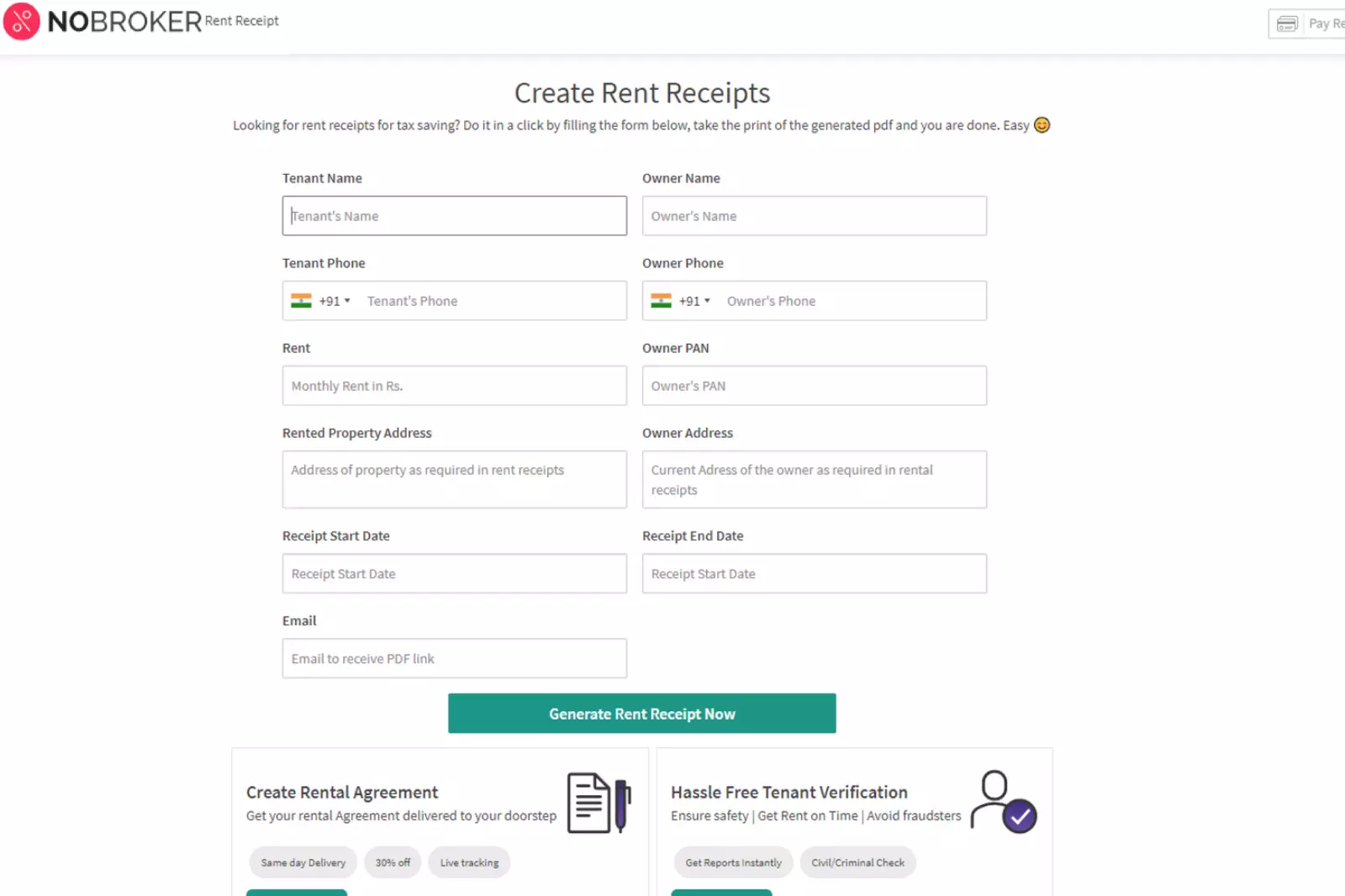

8. Nobroker

Nobroker introduces a seamless approach to house rent receipt generation. Create detailed and compliant receipts effortlessly to streamline your financial documentation. Experience a hassle-free approach to maintaining transparent financial records.

9. esahayak

Simplify your house rent receipt creation with esahayak’s online generator. Effortlessly input your details and generate professional receipts for a transparent and compliant financial record. Explore the user-centric features designed to enhance your overall financial management.

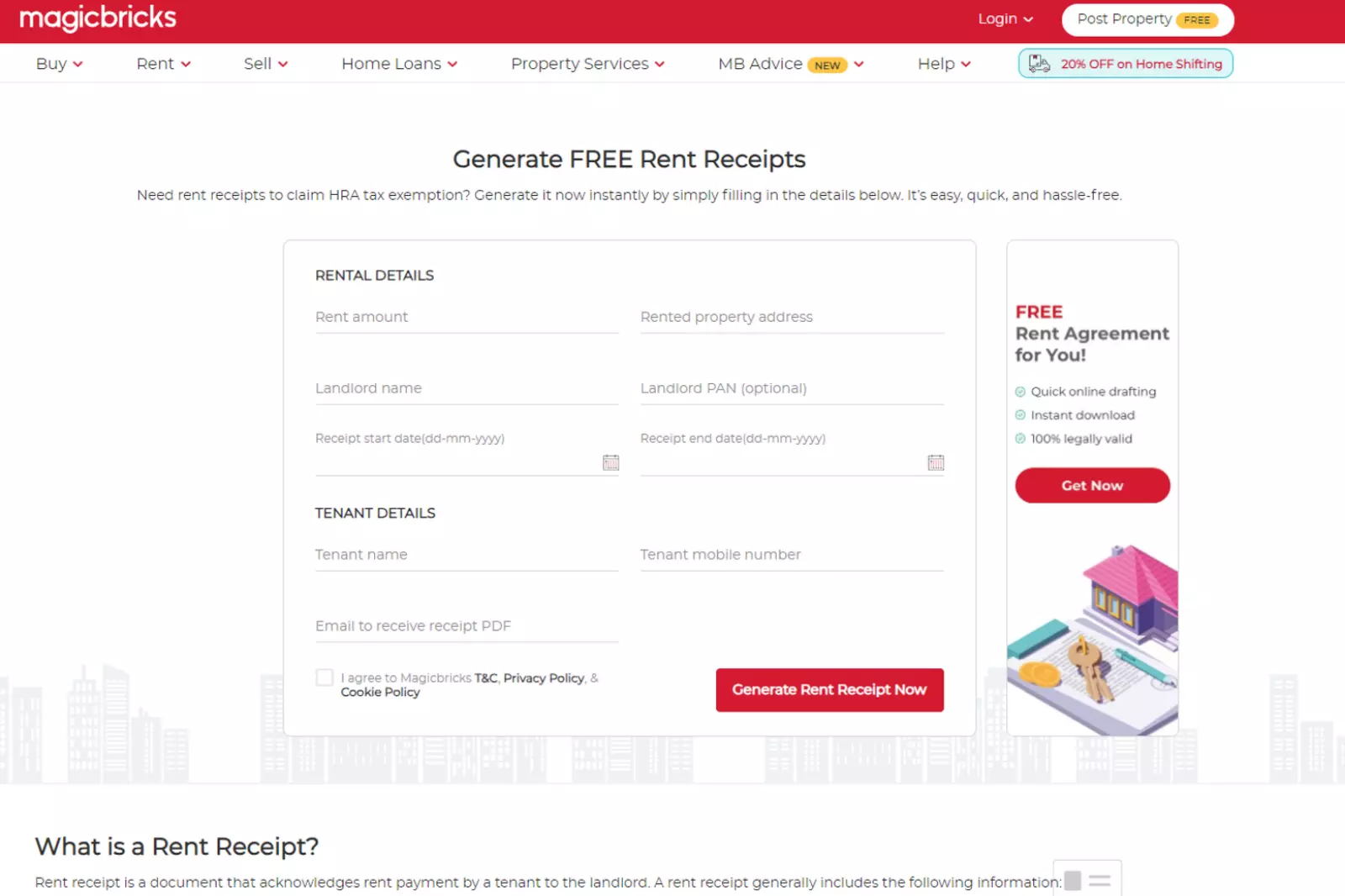

10. Magicbricks

Magicbricks offers a seamless approach to house rent receipt generation. Easily input your details and generate precise receipts to keep your financial transactions transparent. Experience the convenience of a platform designed to simplify your overall financial record-keeping.

Benefits of Creating Rent Receipt Online

1. Efficiency and Convenience

Creating rent receipts online provides a swift and convenient solution, eliminating the need for manual paperwork and reducing time-consuming processes. Online platforms offer user-friendly interfaces, enabling tenants to input details effortlessly and generate receipts promptly. This efficiency is especially beneficial in the fast-paced nature of today’s digital world, allowing for quick and accurate documentation of financial transactions.

2. Transparency in Financial Transactions

Online rent receipts enhance transparency between tenants and landlords. These digital records provide a clear and detailed account of rent payments, ensuring both parties have accurate and accessible information. This transparency fosters trust and mitigates potential disputes, as all financial dealings are well-documented and easily verifiable.

3. Tax Compliance and Benefits

Online rent receipts facilitate tax compliance, particularly for individuals claiming House Rent Allowance (HRA) exemptions. Accurate and well-documented receipts are crucial for justifying HRA claims during tax filing. Online platforms often include features to ensure compliance with tax regulations, making it easier for tenants to avail themselves of eligible tax benefits.

4. Accessibility and Storage

Digital rent receipts offer the advantage of easy accessibility and secure storage. Tenants can access their receipts anytime, anywhere, eliminating the risk of losing or misplacing physical documents. The cloud-based nature of many online platforms ensures that critical financial records are securely stored, providing peace of mind for tenants and landlords.

5. Professionalism and Customization

Online rent receipt generators often offer professionally designed templates that lend a polished and organised look to the documentation. Tenants can customise receipts to include specific details relevant to their rental agreement. This professionalism makes a positive impression and ensures all necessary information is presented, contributing to a well-maintained financial record.

6. Environmentally Friendly

Opting for online rent receipts aligns with eco-friendly practices by reducing the need for paper and ink. The digital nature of these receipts promotes a more sustainable approach to documentation. By minimising the reliance on physical documents, tenants contribute to environmental conservation, making it a choice that aligns with modern efforts towards a greener and more sustainable future.

Conclusion

In conclusion, understanding the significance of rent receipts is crucial for tenants and landlords to foster transparent financial transactions. We explored the necessity of rent receipts for tax benefits, emphasising the ease of claiming House Rent Allowance. Recognising the essential components of a rent receipt ensures completeness and compliance.

Making rent receipts online streamlines the process and contributes to efficiency and accessibility. This guide has illuminated the path to creating these receipts effortlessly, even for those less familiar with financial complications. By embracing the user-friendly nature of online platforms, tenants can easily navigate the world of rent receipts, ensuring accuracy, transparency, and a harmonious landlord-tenant relationship.

Frequently Asked Questions About Rent Receipt (FAQ’s)

Is online rent receipt valid?

Yes, online rent receipts are valid and widely accepted. They serve as digital documentation of rent payments and are often considered equivalent to traditional paper receipts.

How do I get a monthly rent receipt?

You can obtain a monthly rent receipt online or request one from your landlord. Many online tools allow you to generate monthly receipts with ease.

How do I get a digitally signed rent receipt?

Some online rent receipt generators offer the option of adding a digital signature. Ensure the platform you use supports this feature, and follow the provided steps for adding a digital signature.

How do I get an HRA receipt?

To get an HRA receipt, request a rent receipt from your landlord specifying the amount paid and the duration. Ensure it includes essential details like the landlord’s signature and address.

Do we need a stamp for a rent receipt?

It is not mandatory to have a stamp on a rent receipt. However, some regions may have specific requirements, so checking local regulations is advisable.

How much rent paid is tax-free?

The tax-free amount for rent paid depends on various factors, including the HRA received, salary, and rent paid. Consult a tax professional for accurate calculations.

How do I claim rent on ITR?

To claim rent on Income Tax Return (ITR), provide the rent receipt and other required details in the HRA section of the ITR form. Ensure all information is accurate and in compliance with tax regulations.

How much rent can be claimed without PAN?

If the annual rent payment is at most Rs. 1 lakh, providing the landlord’s PAN is optional. However, it is advisable to obtain PAN details for comprehensive tax compliance.

Can I pay rent to my parents?

Yes, you can pay your parent’s rent, which is legally acceptable. Ensure a valid rent agreement and transactions are genuine to avoid legal complications.

Can I pay rent in cash and claim HRA?

Yes, you can pay rent in cash and claim HRA, but ensure you have valid rent receipts and comply with tax regulations. Online platforms also accept digital payment methods for added convenience.