In our everyday lives, bills are like secret helpers in every money exchange we do. Whether you’re paying for the internet, having yummy food at a restaurant, or keeping track of your money for work, bills are like superheroes that keep things in order. Now, picture a world where making these bills is not challenging but happy and easy.

Enter the world of GST bills! These bills are not just regular papers; they are like your digital friends helping you in the money world. They ensure every rupee you spend or earn is written down neatly and clearly.

In this blog, we invite you to explore the simplicity of creating GST bills online with our user-friendly GST Invoice Generator. Our step-by-step plan ensures a stress-free experience, eliminating the need for confusing papers or intricate forms. Whether you’re a business owner or managing household expenses, consider us your reliable companion. Our goal is to make billing a breeze, and with our efficient GST Invoice Generator, handling your finances is easy and delightful. Let’s kick off this exciting journey together and transform how you manage money – with our tool, GST bills become your new, incredible helper!

What is GST?

GST, or Goods and Services Tax, is a positive transformation in taxation that simplifies how we pay taxes on goods and services. It replaces the complex web of multiple taxes with a unified tax system, making life easier for businesses and consumers. With GST, the tax burden is shared fairly across the supply chain, ensuring everyone pays their fair share without surprises.

For individuals, GST means a more straightforward and transparent way of understanding the taxes we pay when buying goods or services. It promotes accountability and reduces the effect of taxes, leading to fairer prices for goods and services. Businesses also benefit by streamlining their tax processes, reducing paperwork, and encouraging a more competitive and efficient market. GST is a people-centric approach to taxation impacting our daily lives and the economy.

History of GST

The history of GST is a journey toward simplifying taxes for the benefit of people and businesses. It was first introduced in France in 1954 and gradually adopted by many countries worldwide. India embraced GST on July 1, 2017, inspired by successful implementations in Canada and Germany. The motto behind GST is to create a unified tax system that encourages economic growth, streamlines processes and ensures fair taxation.

India’s adoption of GST aimed to replace a complex tax structure with a single, simplified system. The “One Nation, One Tax” slogan reflects the essence of GST, unifying the entire country under a simplified tax regime. This positive shift has significantly reduced tax-related hurdles for businesses and made understanding and paying taxes more accessible for individuals. The history of GST showcases a commitment to making the tax system more people-friendly and contributing to the nation’s overall economic well-being.

Why is it Essential to Make a GST Invoice?

Making a GST invoice is not just a formality but a strategic move for businesses in India. It ensures legal compliance, facilitates smooth transactions, and contributes to a transparent and trustworthy financial ecosystem. Here is the detailed information on why it’s essential to make GST invoices:

1. Legal Compliance: As per Indian tax laws, Making GST invoices is mandatory for businesses. It ensures compliance and helps avoid legal issues, providing a secure financial foundation.

2. Input Tax Credit (ITC) Benefits: GST invoices enable businesses and customers to claim Input Tax Credit, reducing the overall tax burden. This encourages fair pricing and cost savings for both parties.

3. Transparent Transactions: GST invoices offer transparency for customers, detailing the exact taxes paid. This transparency builds trust, as customers can verify the accuracy of their transactions.

4. Interstate Transactions Simplified: In India, where businesses operate across states, GST invoices streamline transactions. The standardised format is accepted nationwide, making interstate trade more accessible and efficient.

5. Dispute Resolution with Legal Proof: GST invoices serve as legal proof of dispute transactions. This benefits both businesses and customers, providing clarity and reducing the chances of disagreements.

6. Penalty Avoidance: Proper GST invoicing is crucial for businesses and customers to avoid penalties. Complying with invoicing regulations ensures a smooth financial journey without legal complications.

7. Simplified GST Return Filing: GST invoices are essential for accurate GST return filing. Customers benefit indirectly as businesses equipped with proper documentation can provide better services without delays caused by tax-related issues.

8. Trust-Building for Businesses and Customers: Businesses that maintain clear, GST-compliant invoices build trust. Customers appreciate transparent financial dealings, fostering a positive relationship between buyers and sellers.

9. Preparedness for Audits: Both businesses and customers benefit from GST invoices during government audits. Proper record-keeping ensures a smooth audit process, reducing stress for all parties involved.

10. National Development Contribution: Through GST invoicing, businesses and customers contribute to national development. The taxes collected are utilised for public services and infrastructure, benefiting the nation.

Who Can issue a GST Invoice?

Any registered business entity that supplies goods or services can issue a GST invoice. This includes individuals, partnerships, companies, and other legal entities that have obtained a Goods and Services Tax (GST) registration. You are authorised to issue GST invoices if you’re running a business and have completed the necessary registration process.

Businesses must register for GST if their annual turnover surpasses the specified threshold, allowing them to issue invoices and ensure compliance with tax regulations. By issuing GST invoices, businesses contribute to a transparent and accountable financial system, facilitating smooth transactions and allowing for the proper tracking of goods and services across the supply chain.

When to issue GST invoices

Making GST invoices involves sticking to specific timelines, ensuring compliance with regulations, and maintaining transparency in financial transactions. Here’s a breakdown of the timeline for issuing GST invoices:

- Supply of Goods: In the case of the supply of goods, businesses must Making GST invoices before or at the time of delivery. This ensures that the necessary details are provided to the recipient promptly.

- Supply of Services: For service providers, GST invoices must be issued within 30 days from the date of supply of services. In the case of banks and other financial institutions, this timeline is extended to 45 days.

- Continuous Supply: When the supply involves continuous or periodic services, businesses must issue invoices on or before the due date of payment or the receipt of payment, whichever is earlier.

- Reverse Charge Mechanism: In scenarios where the reverse charge mechanism is applicable, the recipient must issue an invoice on the day of receipt of goods or services.

- Interstate Transactions: For interstate transactions, businesses must issue invoices per the timelines mentioned above, with additional consideration for the time taken for transportation.

Adhering to these timelines ensures smooth financial operations, aids in timely tax compliance, and fosters trust in business transactions. Businesses must stay organised, ensuring that GST invoices are issued within the provided time frames based on the nature of the supply.

Essential Information on GST Invoice

As per the Goods and Services Tax (GST) rules in India, a GST invoice should include the following mandatory information:

1. Invoice Number: Each invoice is assigned A unique identification number for tracking and reference purposes.

2. Date of Invoice: The date on which the invoice is issued, indicating the time of supply.

3. Name and Address of the Supplier: Legal name, address, and GSTIN (Goods and Services Tax Identification Number) of the supplier.

4. Name and Address of the Recipient: Legal name, address, and GSTIN of the recipient (if the recipient is registered under GST).

5. HSN (Harmonized System of Nomenclature) Code: For goods, the HSN code should be provided to classify the products. For services, the SAC (Services Accounting Code) should be mentioned.

6. Description of Goods or Services: A clear and detailed description of the goods or services being supplied.

7. Quantity of Goods or Services: The quantity of goods or extent of services provided.

8. Total Value of Supply: After considering discounts or taxes, the total supply value.

9. Taxable Value and Discounts: The taxable value of the supply and any discounts provided.

10. Applicable GST Rate: The GST rate applicable to each item, along with the type of tax (CGST, SGST/UTGST, IGST).

11. Amount of GST Charged: The amount of GST charged for each tax component (CGST, SGST/UTGST, IGST).

12. Place of Supply: The location where the goods or services are supplied, especially for interstate transactions.

13. Reverse Charge Mechanism (if applicable): If the reverse charge mechanism is applicable, it should be mentioned on the invoice.

14. Signature or Digital Signature of the Supplier: A physical or digital signature of the supplier or their authorised representative.

Ensuring that these details are included in a GST invoice helps maintain compliance with the GST regulations in India.

What is the HSN code in the GST invoice?

The Harmonized System of Nomenclature (HSN) code is a numerical classification system for goods adopted under India’s Goods and Services Tax (GST) regime. It’s designed to streamline the taxation process by categorising products based on their nature.

HSN codes are typically 2- to 8-digit alphanumeric codes, where the first two digits represent the chapter, the next two the heading, and the following digits the sub-heading. The structure helps in accurate classification and simplifies the tax calculation process.

Business Requirements:

For Businesses Exceeding 5 Crores: They must provide detailed HSN codes up to 4 digits on GST invoices. This detailed classification aids in a more granular understanding of traded goods.

For Businesses between 1.5 to 5 Crores: Businesses within this revenue range must provide HSN codes up to 2 digits. While less detailed than the higher bracket, it still offers substantial classification for taxation purposes.

Businesses Exporting Products: The requirement for business exporting goods extends to providing 8-digit HSN codes on invoices. This detailed coding ensures compliance with international standards and facilitates smoother cross-border trade.

Importance of HSN Code in GST:

The HSN (Harmonized System of Nomenclature) code holds paramount importance in GST (Goods and Services Tax) as it streamlines the taxation process for goods. As a universal language for product classification, HSN codes aid businesses in accurate and transparent invoicing.

This system ensures that each product is categorised uniquely, facilitating seamless transactions and preventing errors in tax calculations. The importance of HSN codes in GST is evident in their role in enhancing efficiency, reducing ambiguity, and promoting uniformity, ultimately contributing to a more streamlined and effective tax framework.

How to Create GST Invoice Online?

Let’s start with simplifying your invoicing process! Making GST invoices online is efficient and hassle-free in the digital era. Follow these steps to Make GST invoice with an online GST invoice generator effortlessly:

1. Visit the Site: Navigate to billgenerator.online to access the user-friendly interface.

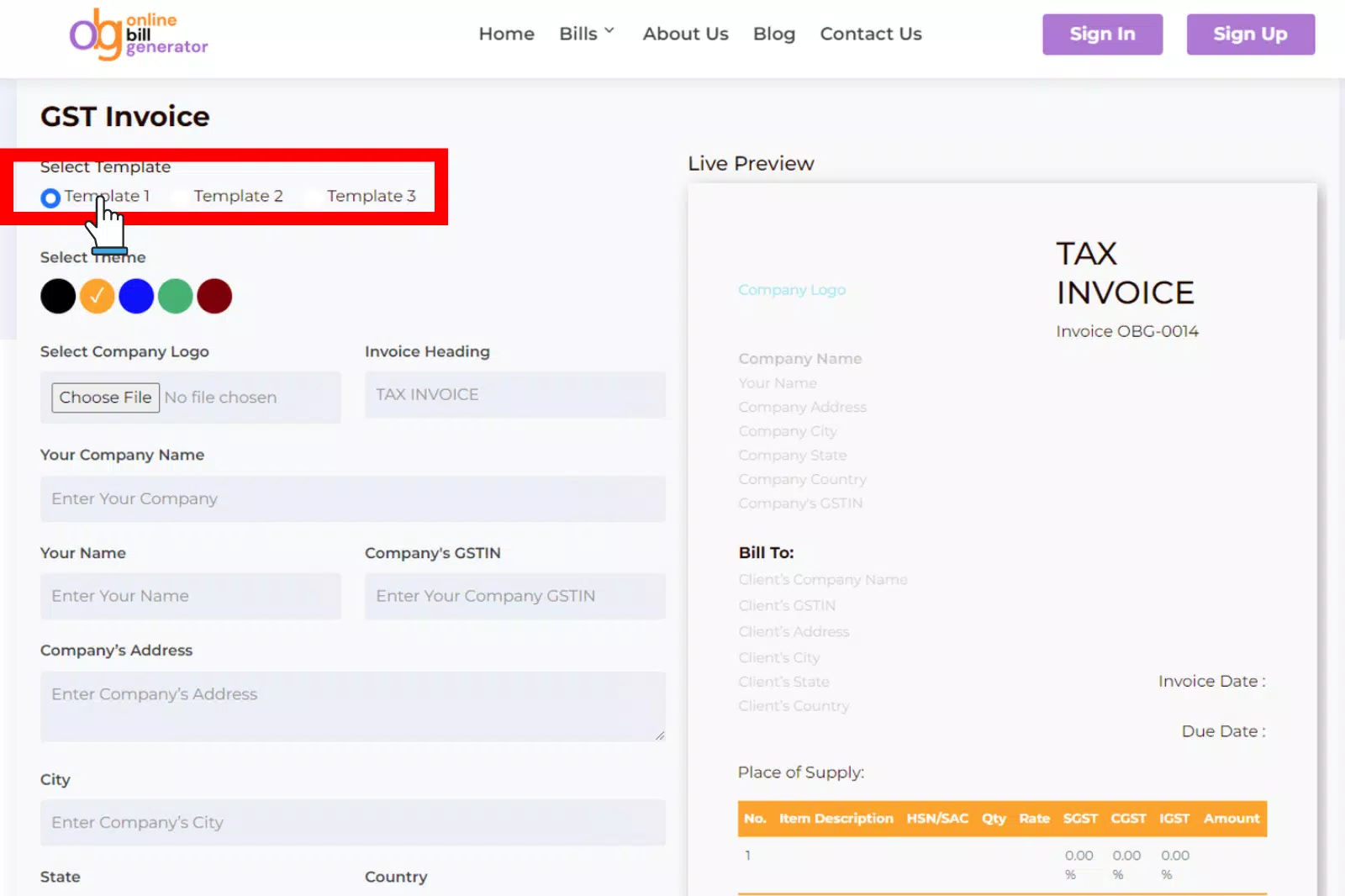

2. Choose a Template: Browse and choose a suitable template from the provided templates for your GST invoice.

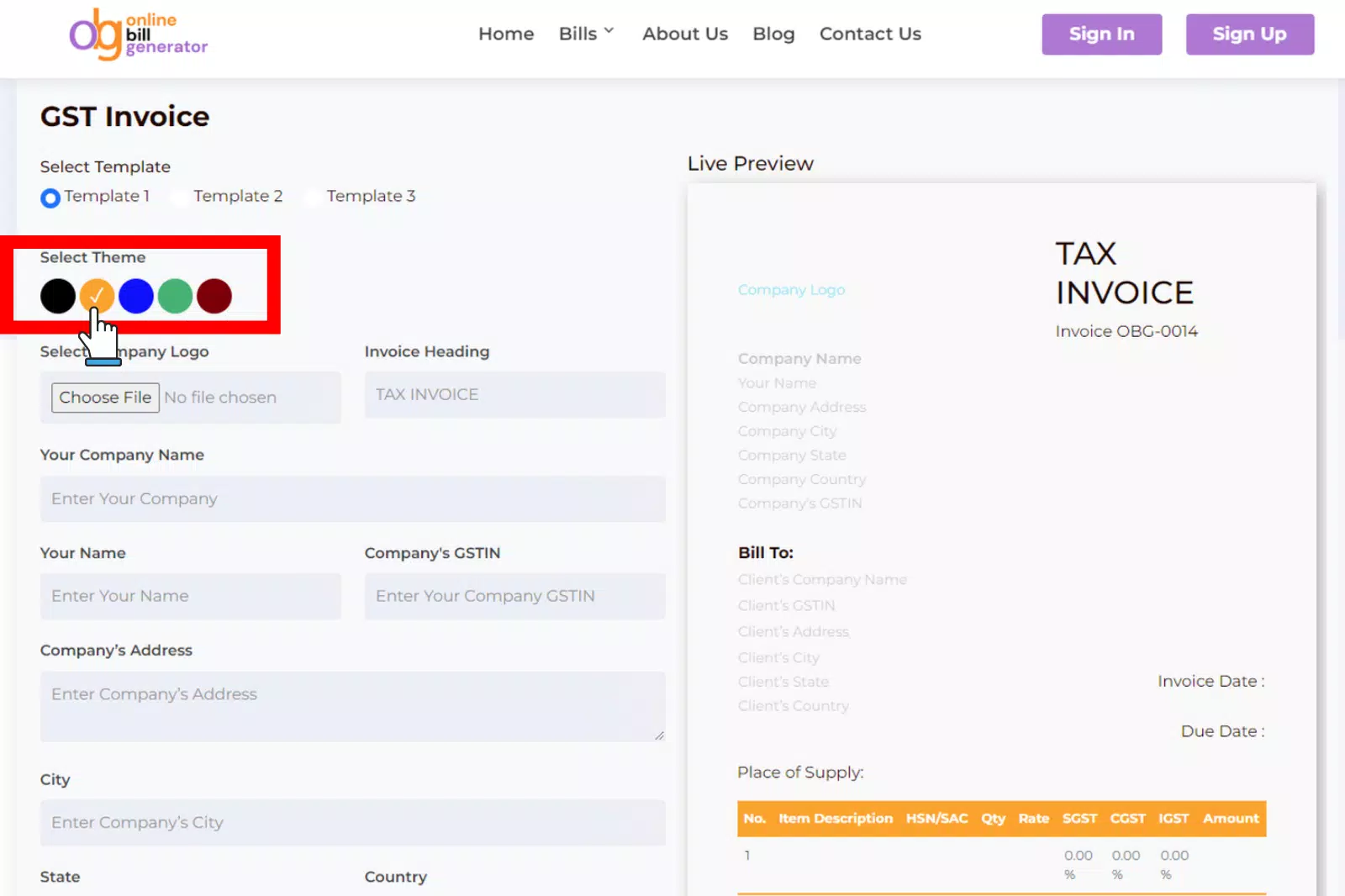

3. Select Theme Color: Personalize your invoice by selecting a colour that aligns with your brand or preference.

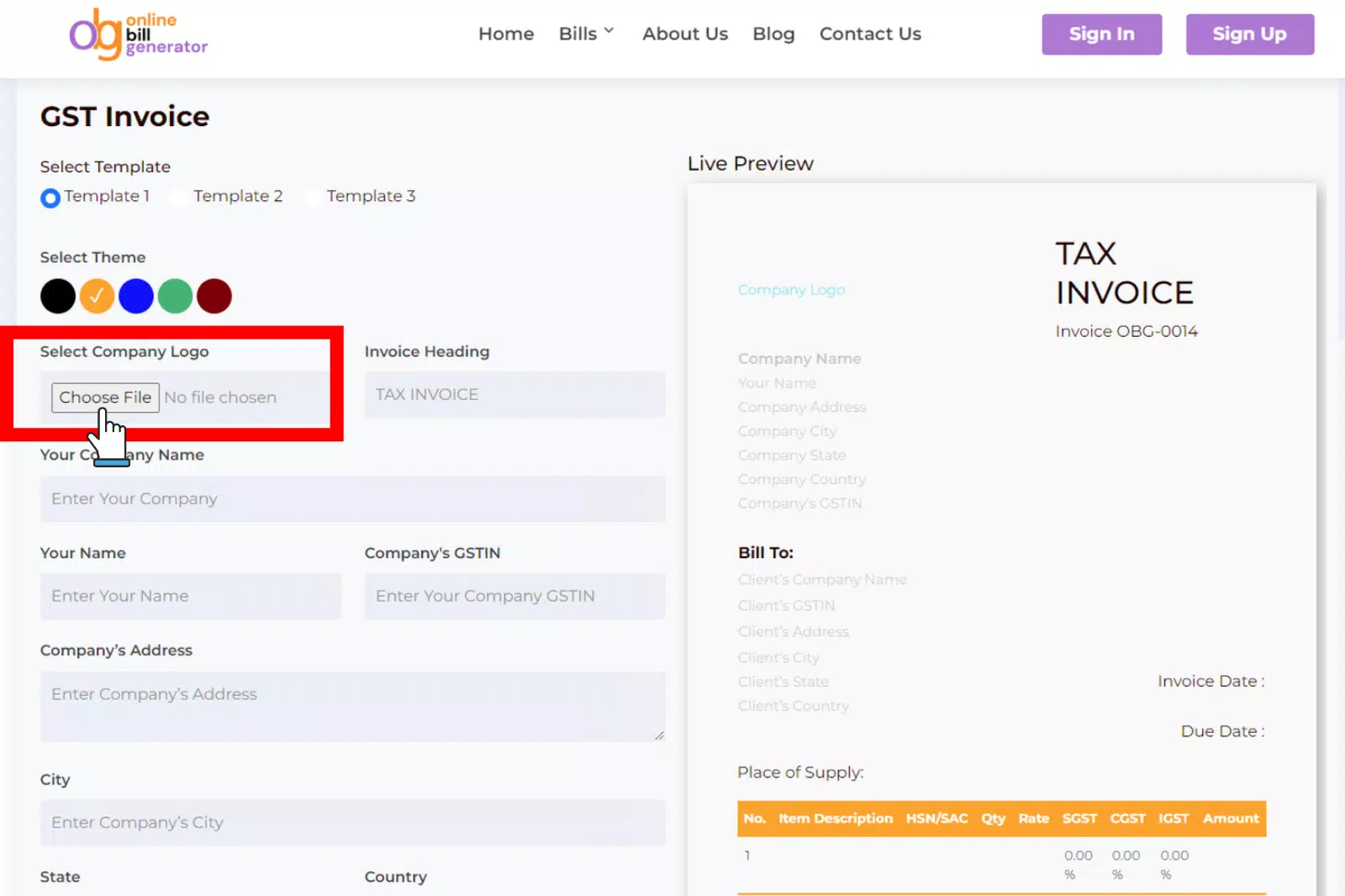

4. Upload Company Logo: Enhance the professionalism of your invoice by uploading your company logo.

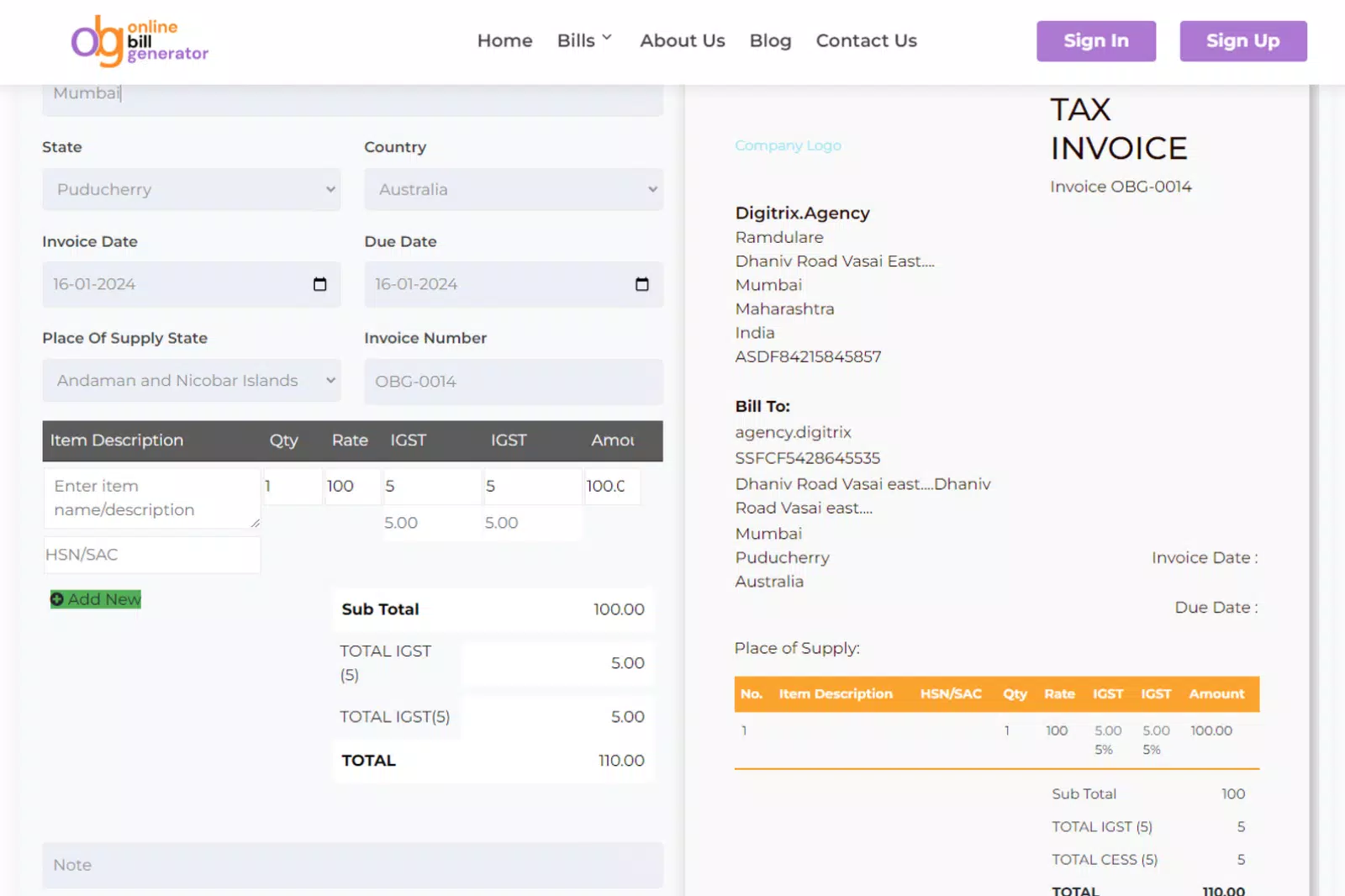

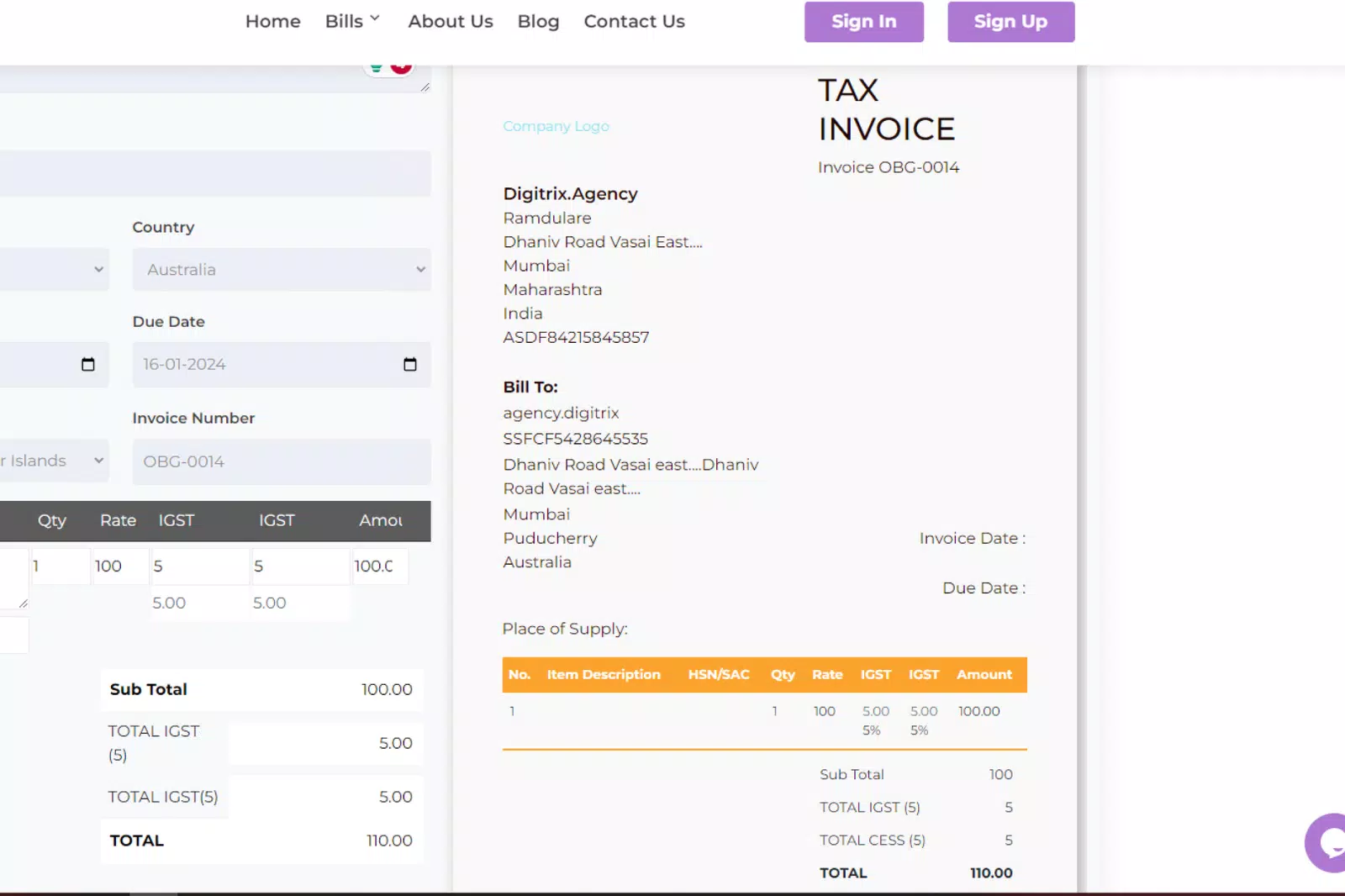

5. Fill Proper Details: Input essential details such as business name, address, GSTIN, customer details, and itemised product or service information.

6. Preview the Result: View a real-time preview of your invoice on the right side of the screen after filling in the details.

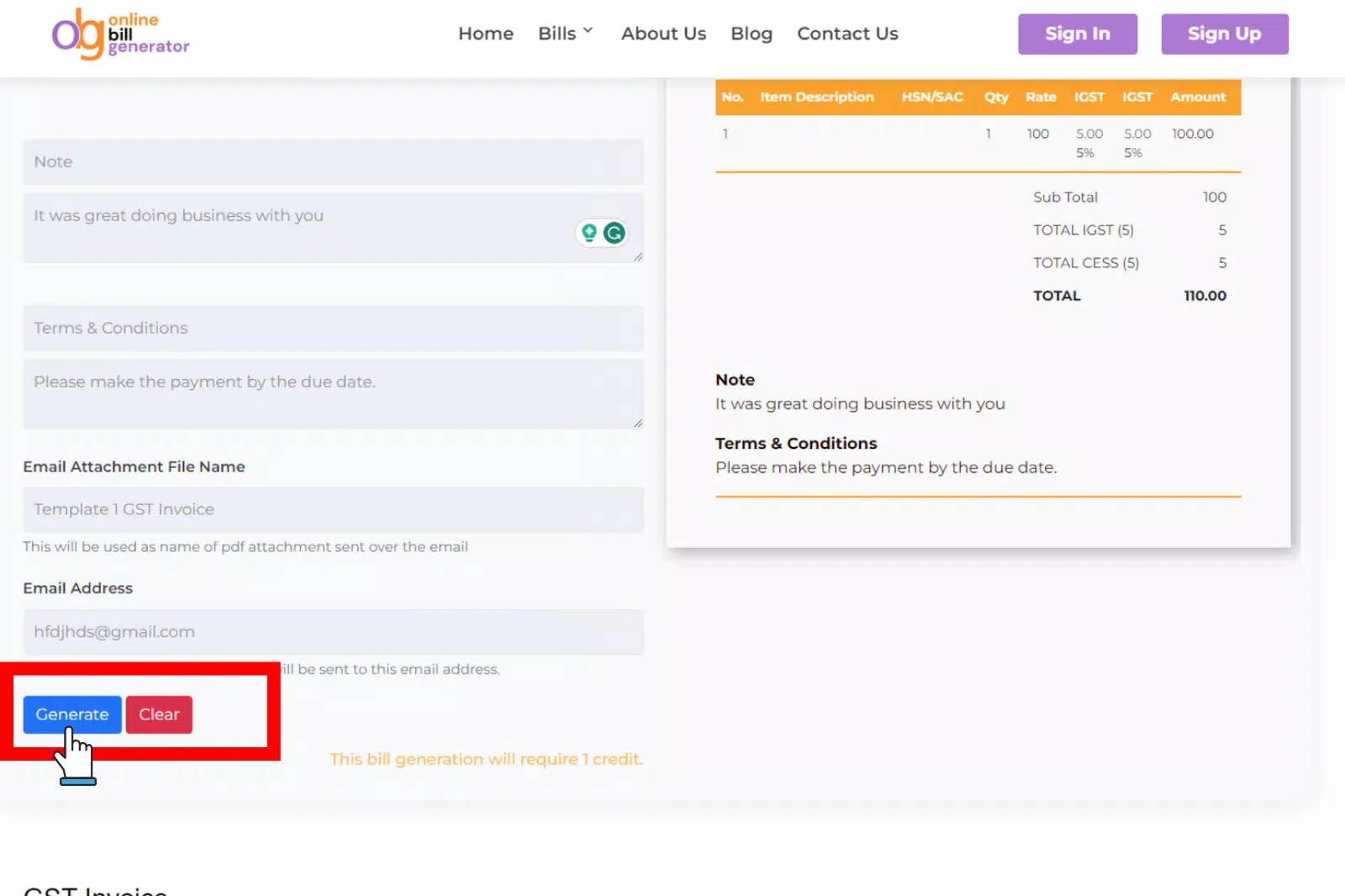

7. Click on Generate: Once satisfied with the preview, click the “Generate” button to download the GST invoice in PDF format.

Top 10 Tools to Create GST Invoice Online

1. billgenerator.online

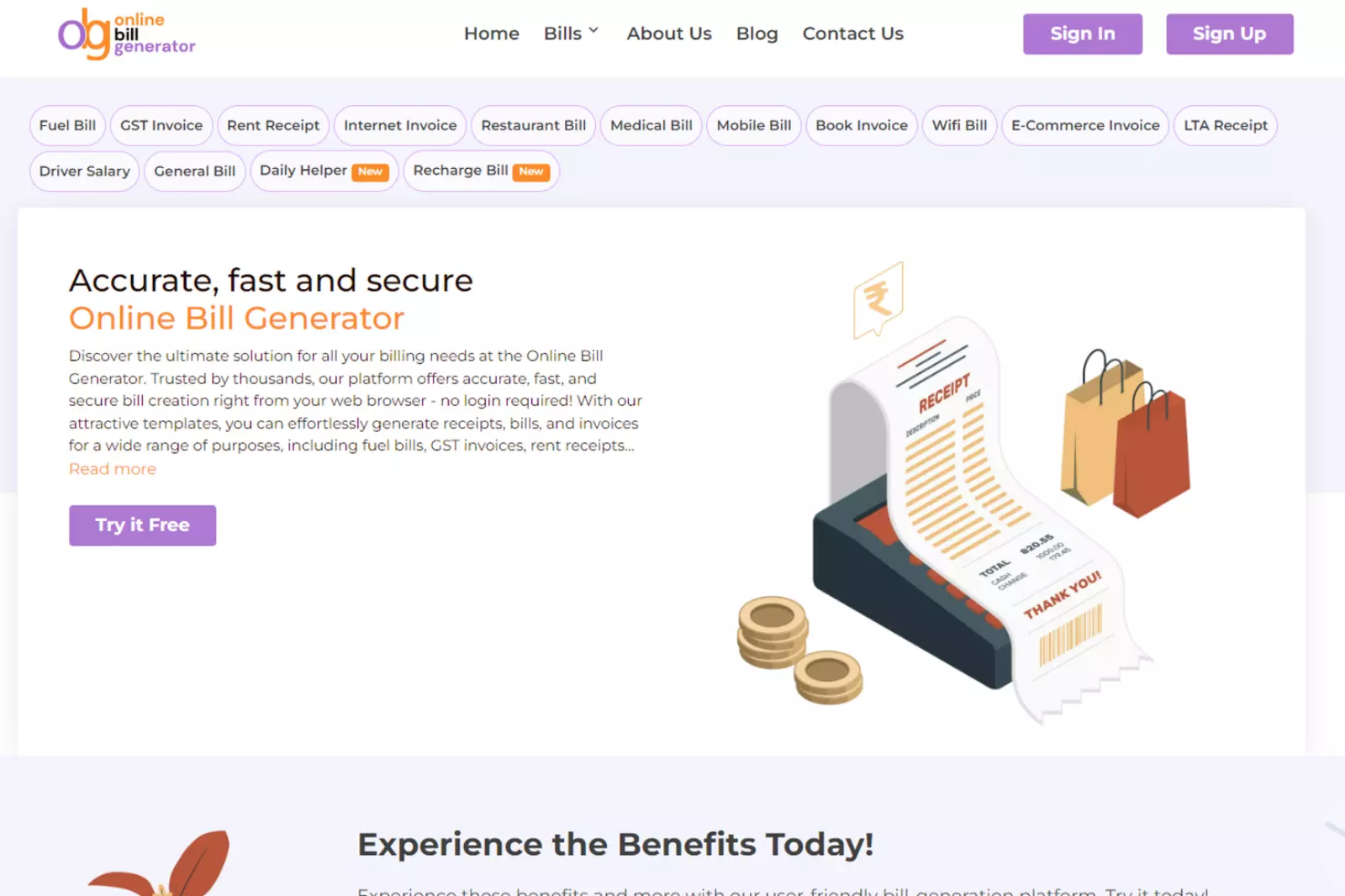

Bill Generator Online stands out as the best online GST invoice generator, offering an unparalleled combination of user-friendly design and robust functionality. Its intuitive UI ensures a seamless experience, allowing users to create and customise GST-compliant invoices effortlessly. Its versatility sets it apart – it goes beyond being just a GST invoice generator.

This platform caters to a diverse range of billing needs, including fuel bills, rent receipts, internet invoices, restaurant bills, medical invoices, book bills, general bills, and more. With its comprehensive features and ease of use, Bill Generator Online is the top choice for businesses looking for a versatile and efficient billing solution.

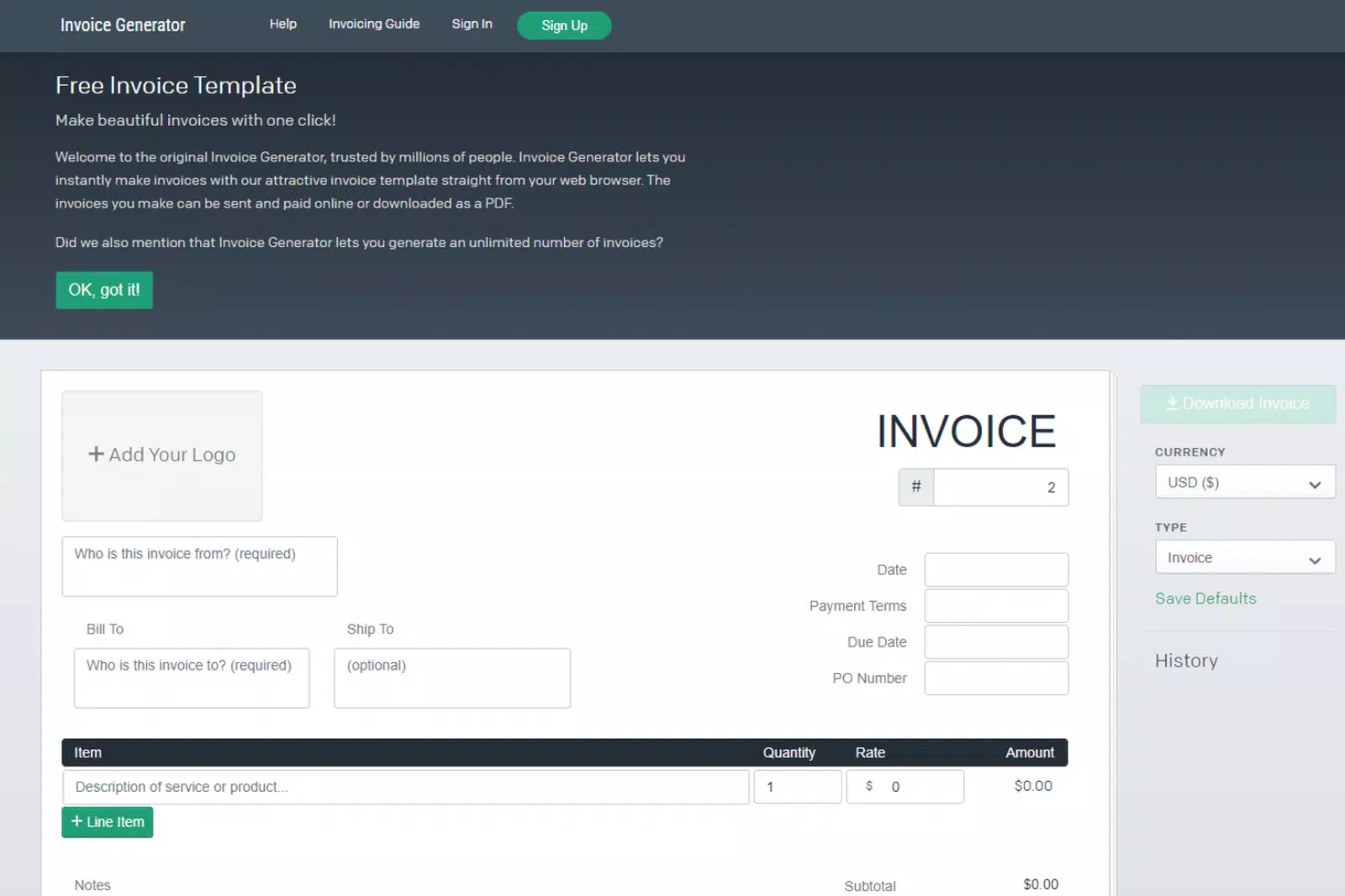

2. Invoice Generator

Meet the Invoice Generator, tailored for ease of use. This platform ensures a quick and efficient solution for creating personalized invoices. Its user-friendly interface and customizable templates make it a top choice for businesses looking to streamline their billing processes effortlessly.

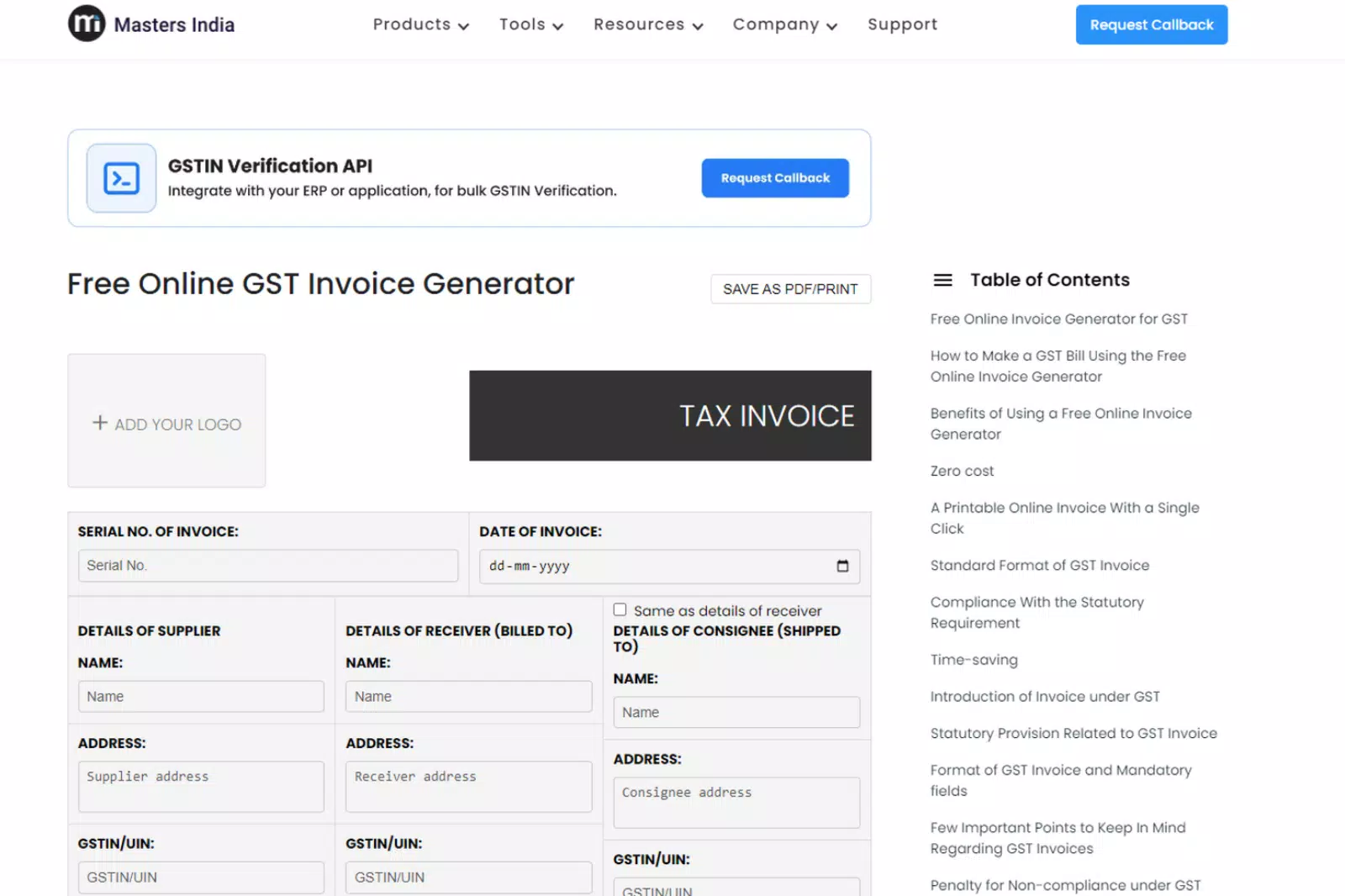

3. Master India

Experience precision and versatility with Master India’s Online GST Invoice Generator. This tool stands out for its meticulous features and user-friendly layout, offering businesses a holistic invoicing solution. Customizable templates ensure compliance with GST regulations and provide a unique touch to your invoices.

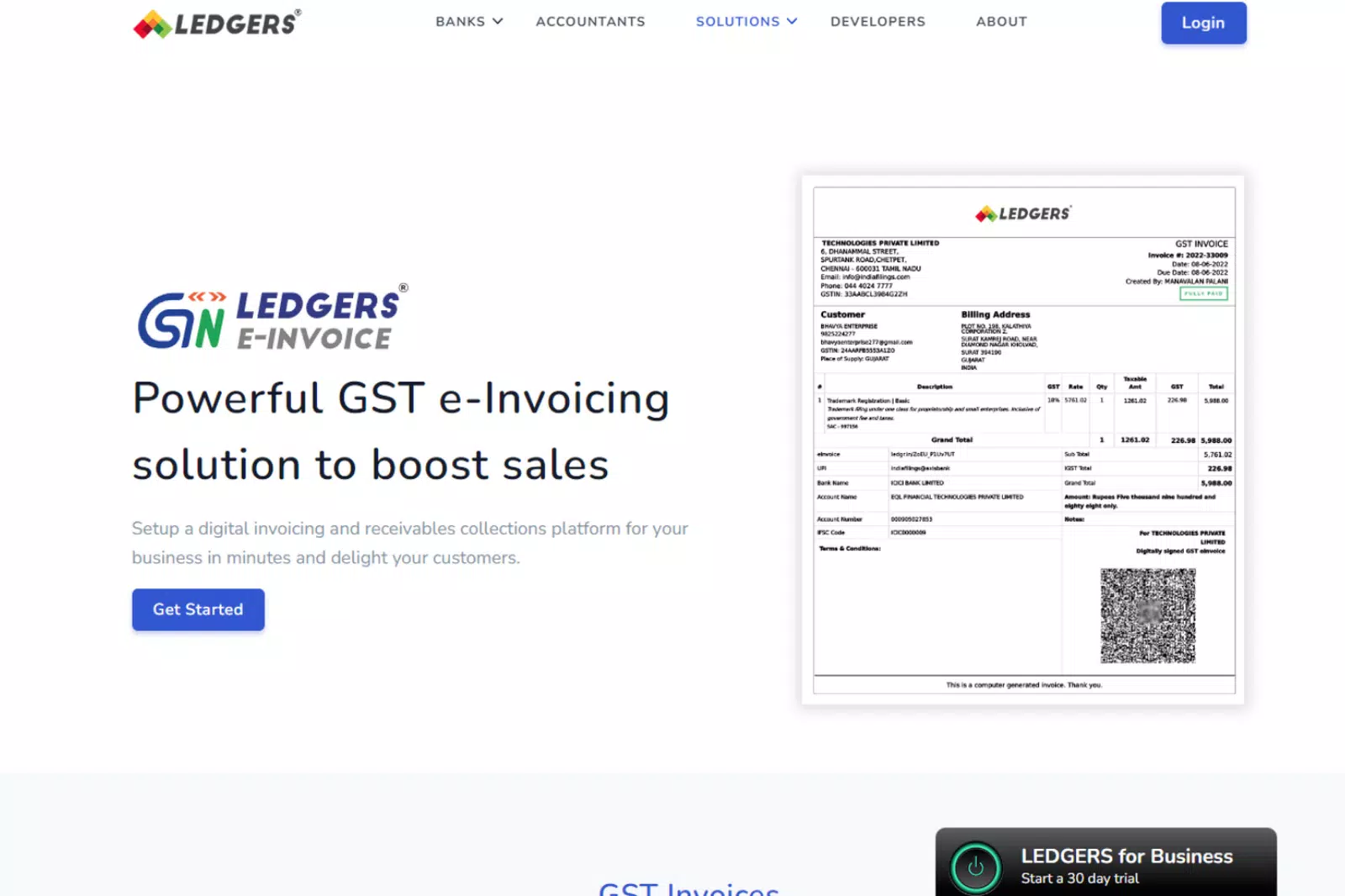

4. Ledgers

Simplify your invoicing journey with Ledgers, where user-friendliness meets powerful functionalities. This platform provides an ideal space for businesses seeking a seamless and efficient solution for generating accurate invoices. With a focus on ease of use, Ledgers transforms complex invoicing into a straightforward process.

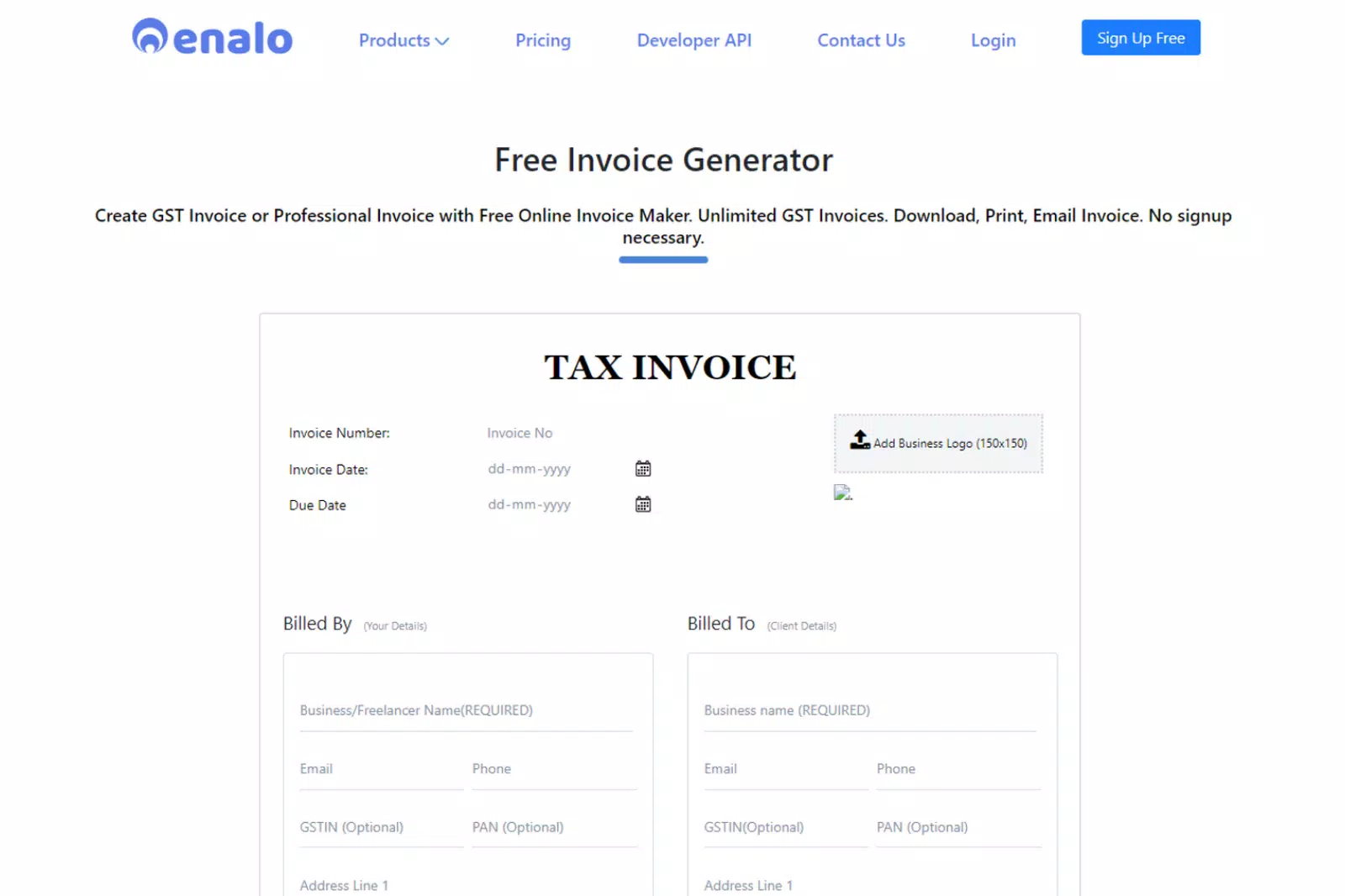

5. Enalo

Enalo’s Online GST Invoice Generator seamlessly integrates simplicity with robust features, offering businesses an efficient tool for creating accurate and GST-compliant invoices. Its straightforward design ensures that even intricate invoicing processes become effortlessly manageable.

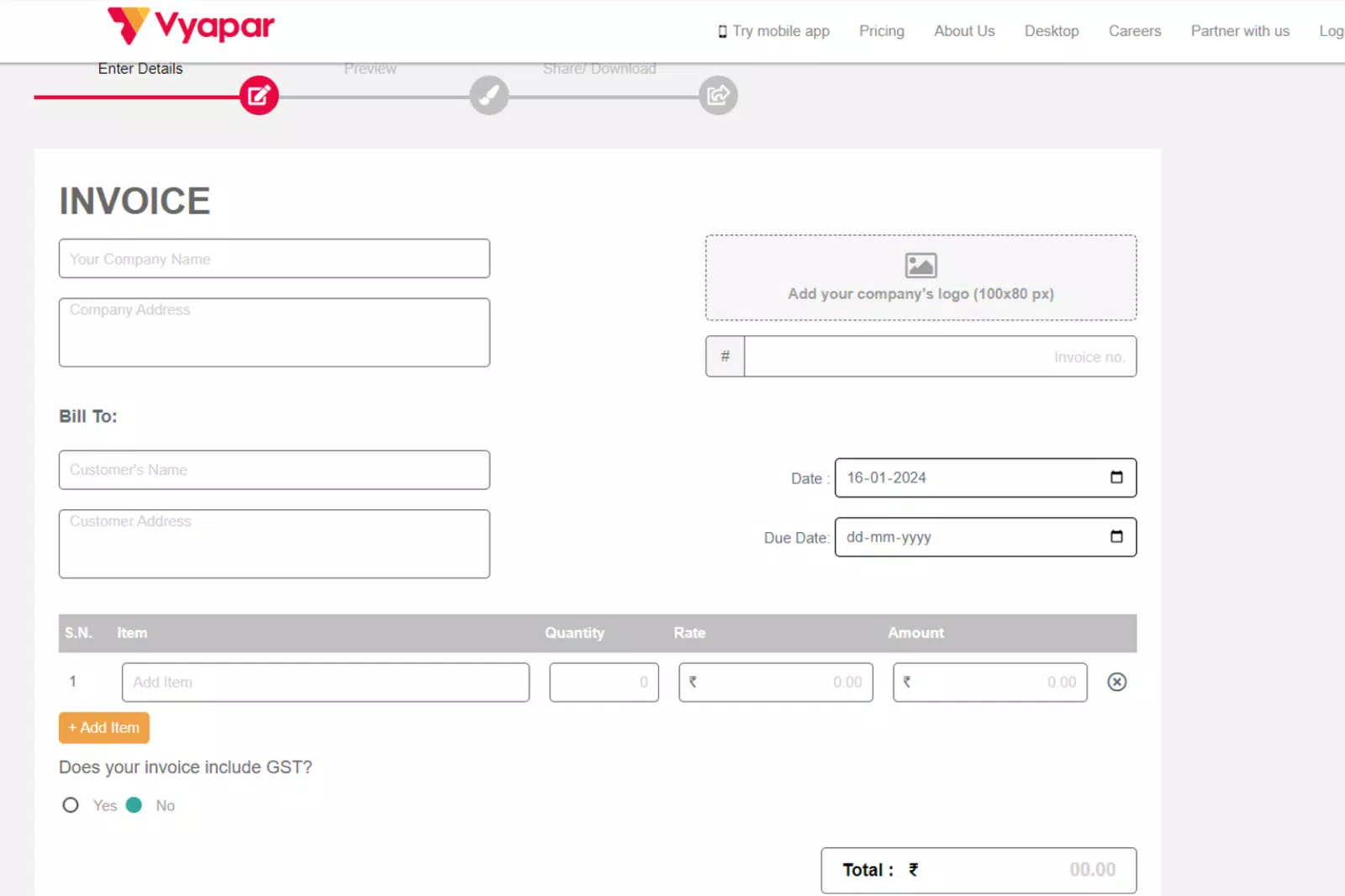

6. Vyapar App

Vyapar App introduces a robust Online GST Invoice Generator tailored to diverse invoicing needs. This platform excels in precision and compliance, offering businesses a comprehensive solution for meticulous financial documentation. With an emphasis on versatility, the Vyapar App stands out in inefficient financial management.

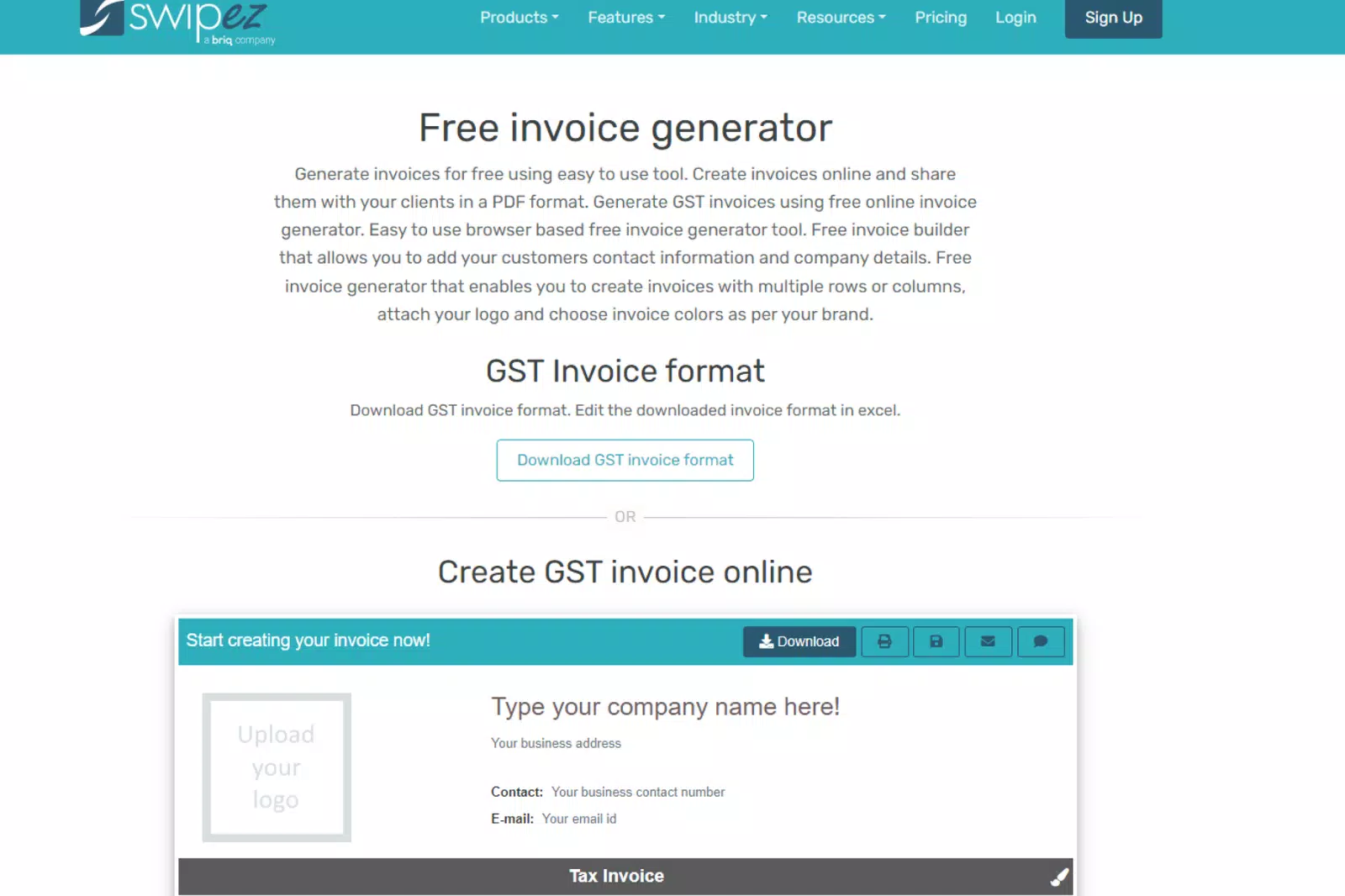

7. Swipez

Elevate your invoicing experience with Swipez’s Online GST Invoice Generator, designed specifically for businesses. Prioritising accuracy and compliance, this platform provides an intuitive environment for efficiently managing financial transactions. With its user-centric approach, Swipez redefines the invoicing process.

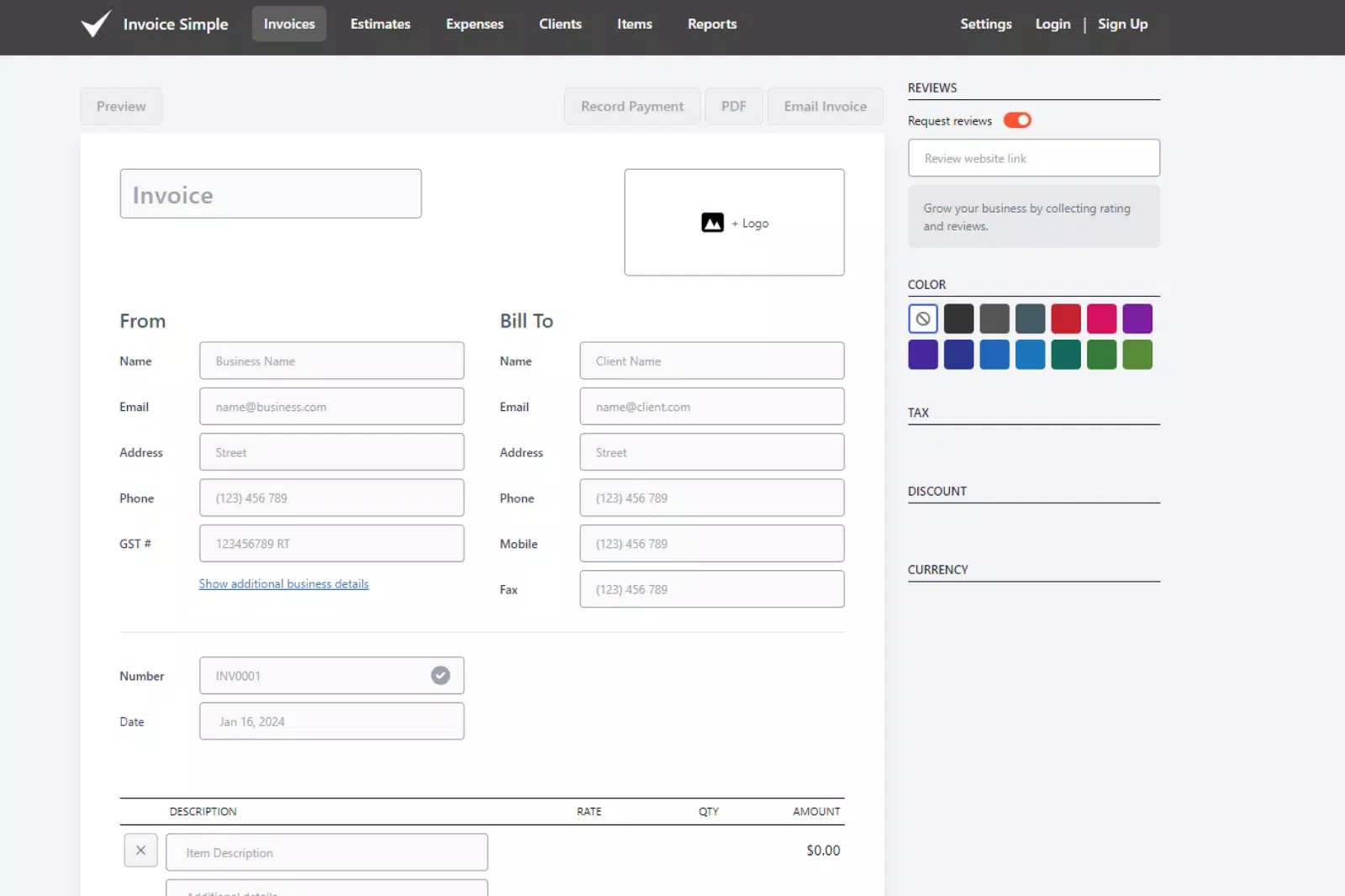

8. Invoice Simple

Invoice Simple emerges as a standout choice for businesses seeking a reliable and user-friendly Online GST Invoice Generator. With customisable options and an intuitive interface, it simplifies financial documentation, making creating professional invoices a straightforward and stress-free endeavour.

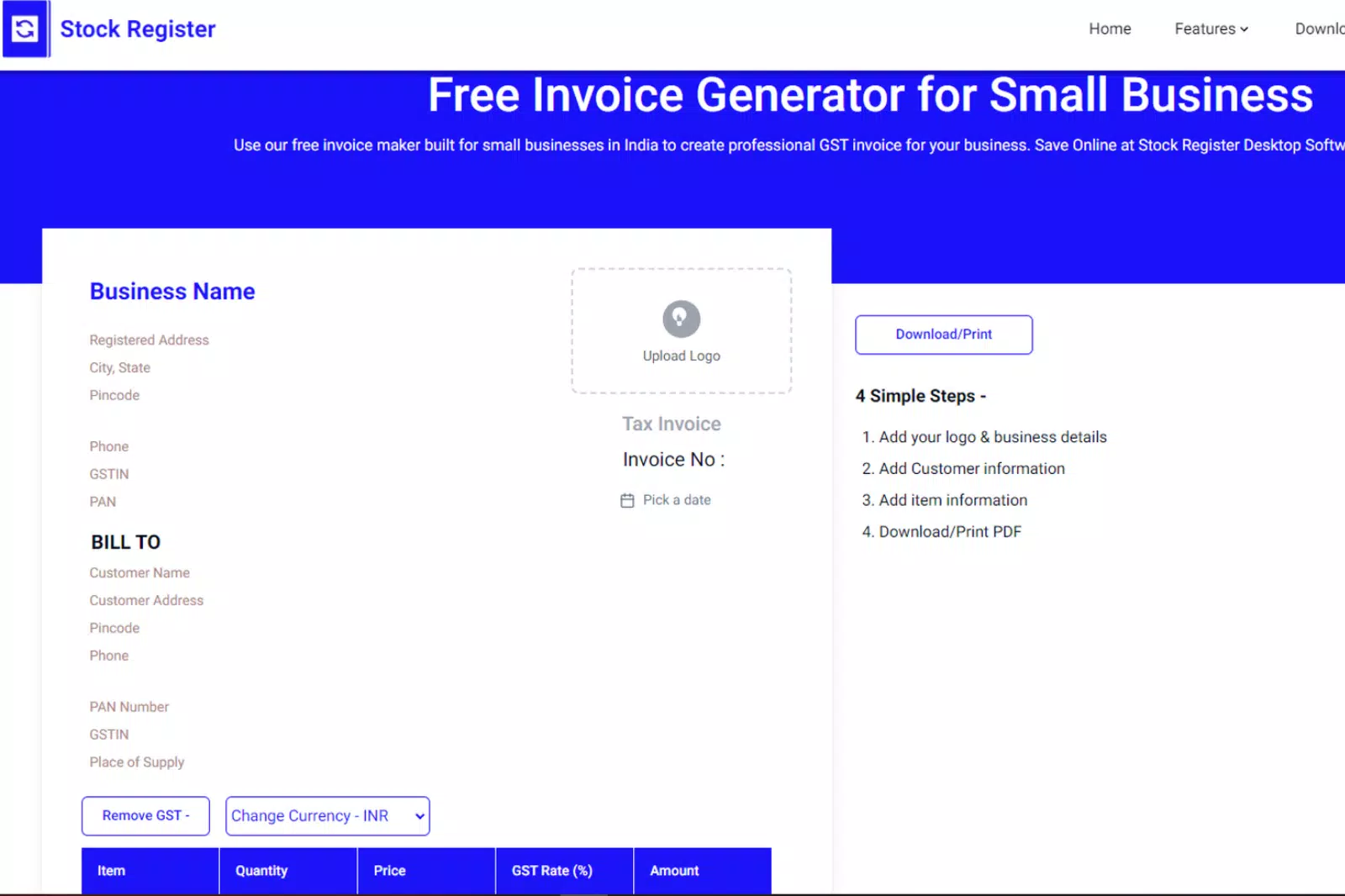

9. Stock Register

Stock Register’s Online GST Invoice Generator simplifies the invoicing process. Boasting a user-friendly platform and versatile features, it provides businesses with a seamless solution for creating accurate and compliant invoices tailored to their unique requirements.

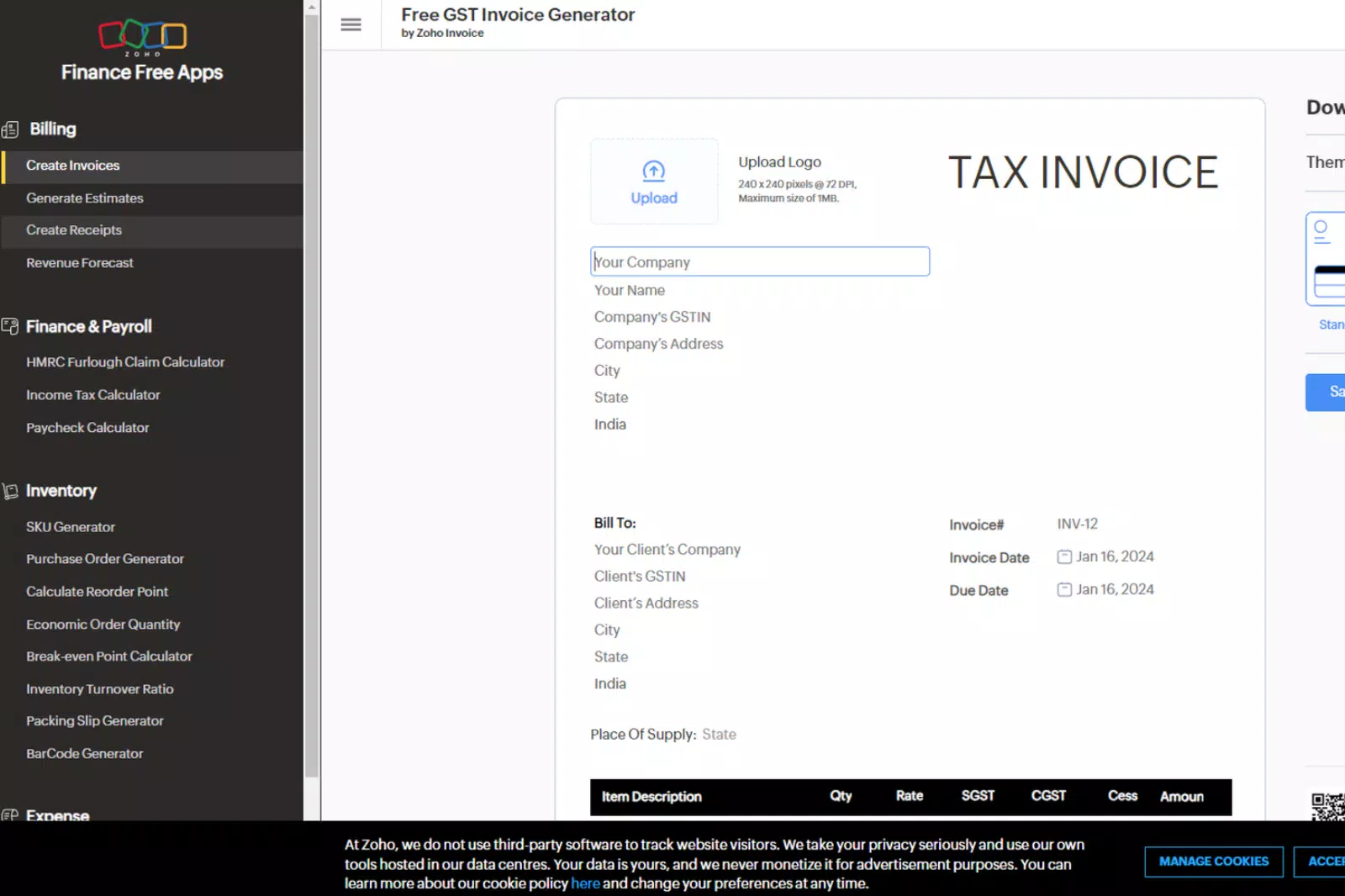

10. Zoho

Zoho’s Online GST Invoice Generator sets itself apart with a perfect blend of functionality and user-friendly design. Addressing a spectrum of invoicing needs offers a seamless experience for creating, customising, and managing invoices with precision and compliance.

Benefits of Using an Online GST Invoice Generator

Using an online GST invoice generator offers numerous benefits for businesses, streamlining the invoicing process and enhancing overall efficiency. Here are five key advantages:

1. Time Efficiency: Online GST invoice generators automate invoicing, saving businesses significant time. The automated generation of invoices reduces manual effort, allowing quicker turnaround times and more efficient workflow.

2. Accuracy and Compliance: These tools are designed to adhere to GST regulations, ensuring that your invoices are accurate and comply with tax laws. This helps businesses avoid penalties and legal complications, fostering a more secure financial environment.

3. Customization and Branding: Online GST invoice generators often provide customisable templates, allowing businesses to personalise their invoices with company logos, colours, and branding elements. This ensures a professional and consistent brand image in all financial transactions.

4. Record-Keeping and Organization: The digital nature of online invoicing facilitates efficient record-keeping. Invoices are stored digitally, making it easy to organise, retrieve, and track financial transactions. This contributes to better financial management and aids in audits or financial reviews.

5. Accessibility and Mobility: Many online GST invoice generators are cloud-based, enabling businesses to access and generate invoices from anywhere with an internet connection. This mobility is especially beneficial for businesses with remote or on-the-go operations, providing flexibility and accessibility to invoicing tools.

By leveraging the benefits of online GST invoice generators, businesses can expedite their invoicing processes and ensure accuracy, compliance, and enhanced organisational efficiency in managing their financial transactions.

Conclusion

In conclusion, our exploration of online GST invoicing has provided a comprehensive guide covering GST fundamentals, historical context, HSN codes, and the step-by-step process of creating invoices online. We’ve emphasised the benefits of online invoicing, such as time efficiency, accuracy, and customisation.

Among the various tools discussed, BillGenerator.online is the premier choice, offering an intuitive interface and versatile features. It simplifies the invoicing process and serves as a multifunctional solution. As businesses navigate the complexities of GST, the efficiency and effectiveness of BillGenerator.online make it the ideal tool for seamless financial management.

Frequently Asked Questions About GST Invoice (FAQ’s)

How can I generate a GST invoice?

Use an online GST invoice generator like billgenerator.online for a simple and efficient way to create GST-compliant invoices. Follow the user-friendly steps provided on the platform.

Who needs GST invoice?

Any business involved in the supply of goods or services and registered under GST must issue GST invoices for transactions.

Who can issue GST invoice?

Any registered business entity under GST can issue a GST invoice. This includes individuals, partnerships, and companies.

How to calculate GST?

GST calculation involves multiplying the taxable amount by the applicable GST rate (CGST + SGST or IGST).

Can I issue an invoice without GST?

No, issuing GST invoices for goods or services is mandatory if your business is registered under GST.

How do I write a GST invoice?

Use the details the buyer and seller provided, including GSTIN, HSN codes, and other mandatory components. Online tools like billgenerator.online guide you through this process.

What is the TDS for GST?

There is no TDS (Tax Deducted at Source) for GST. TDS is a separate tax deducted on certain types of income.

What is the GST formula easy?

GST calculation is straightforward: GST amount = (Original Cost * GST Rate) / 100.

How do you calculate 18% GST?

Multiply the original cost by 18% (0.18) to calculate the GST amount.

What is the GST percentage?

The GST percentage varies: 5%, 12%, 18%, or 28%, depending on the type of goods or services. The GST Council determines the applicable rate.