Managing our finances in today’s digital age has become easier than ever. When claiming your Leave Travel Allowance (LTA) benefits, creating a receipt online can save you time and effort. Understanding how to generate an LTA receipt digitally ensures smooth tax claims and maximizes your benefits.

In this blog post, we’ll walk you through the step-by-step process using simple language that even a sixth grader can grasp quickly. We’ve covered everything from gathering the necessary information to choosing the right online tool. By following our guide, you’ll learn how to efficiently create an LTA receipt online, empowering you to take control of your financial documentation confidently. Let’s dive in and simplify the process together!

What is LTA and why it’s important?

Leave Travel Allowance (LTA) is a component of the salary package provided by employers to their employees. It allows employees to claim reimbursement for expenses incurred while travelling on leave. This benefit encourages employees to take periodic breaks from work and explore new destinations with their loved ones. LTA typically covers expenses related to travel fares, such as airfare, train tickets, or bus tickets, along with hotel accommodation costs.

LTA holds significant importance as it not only promotes work-life balance but also offers tax benefits to employees. Under the Income Tax Act, employees can claim tax exemption on the amount received as LTA, subject to certain conditions. This exemption is available for travel expenses incurred for the employee and their immediate family, including spouses, children, and dependent parents.

By availing of LTA, employees can enjoy quality time with their families without worrying about the financial burden of travel expenses. It encourages a positive work culture by recognising employees’ need for relaxation. Additionally, the tax benefits associated with LTA help employees save money and reduce their tax liabilities, ultimately enhancing their overall financial well-being. LTA is a valuable perk promoting employee satisfaction, productivity, and financial stability.

Necessary Components in LTA Receipt

A well-constructed LTA (Leave Travel Allowance) receipt comprises several key components, each crucial in documenting travel expenses. From the departure location to payment details, these components provide a comprehensive overview of the journey and ensure accuracy in LTA claims. Let’s explore each component in detail to understand its significance in creating an effective LTA receipt.

1. Departure Location: The departure location indicates where the journey begins. Including this information is essential to clarify the travel’s starting point.

2. Departure Time and Date: The departure time and date specify when the journey commenced. This information helps verify the travel timeline and is crucial for LTA claims.

3. Destination Details: Destination details outline where the traveller is headed. Including this information ensures clarity on the final destination of the journey.

4. Passenger Details: Passenger details include the names and any relevant identification details of the individuals travelling. This component helps identify who the receipt is for and ensures accuracy in documentation.

5. Seat Number: The seat number indicates the seat assigned to the passenger during the journey. This detail is essential for transportation providers to ensure proper seating arrangements and for passengers to locate their seats quickly.

6. Ticket Number: The ticket number serves as a unique identifier for the travel ticket. It is necessary for referencing and tracking purposes, facilitating more accessible communication between travellers and transportation providers.

7. Payment Amount and Tax: The payment amount specifies the total cost incurred for the travel, including any applicable taxes. This component ensures transparency regarding expenses and accurately facilitates reimbursement or tax claims.

Each component is vital in creating a comprehensive LTA receipt, providing essential information about the journey and expenses incurred. Including these details ensures clarity, accuracy, and compliance with LTA claim requirements.

Struggles with Manual LTA Bill Receipt Generation

Navigating the complexities of manual LTA (Leave Travel Allowance) bill receipt generation poses significant challenges for employees and employers. From time-consuming processes to potential errors and compliance issues, the struggles with manual receipt generation highlight the pressing need for streamlined and efficient solutions.

1. Time-Consuming Process:

Crafting LTA receipts manually involves significant time and effort, as it requires gathering and organising travel expense details, calculating totals, and formatting the receipt. This time-consuming process can be particularly challenging for busy individuals with limited spare time for administrative tasks.

2. Prone to Errors:

Manual LTA bill receipt generation is susceptible to errors, including calculation mistakes, transcription errors, and inconsistencies in formatting. These errors can lead to discrepancies in the receipts, which may result in delays or rejections during reimbursement or tax claim processes.

3. Difficulty in Tracking Expenses:

Tracking travel expenses for LTA claims can be challenging without automated systems. Manual methods make it harder to maintain accurate records of expenses incurred during travel. This lack of tracking capability can lead to confusion and difficulties in providing necessary documentation for reimbursement or tax purposes.

4. Limited Accessibility:

Manual LTA receipt generation restricts accessibility, as it often requires physical access to receipts and documents stored in files or folders. This limitation makes it inconvenient for employees to access their receipts when needed, especially if they are not in the office or do not have access to physical copies.

5. Inefficiency in Compliance:

Manual processes may need help to ensure compliance with company policies or regulatory requirements regarding LTA receipt formatting and documentation. With standardised procedures and automated checks, ensuring consistency and accuracy in LTA receipts is easier, potentially leading to compliance issues.

6. Increased Administrative Burden:

Manual LTA receipt generation adds to the administrative burden of employees and finance teams, requiring additional time and resources to manage and process receipts. This increased workload can detract from more strategic tasks and reduce efficiency in expense management processes.

Benefits of Using Online Bill Generator for LTA Receipt

1. Convenience:

Bill Generators Online offer unparalleled convenience by allowing users to create LTA receipts anytime, anywhere. Whether at home, in the office, or travelling, you can easily access these platforms with an internet connection. Gone are the days of relying on physical locations or specific software to generate receipts. With online generators, everything you need is at your fingertips, making the process incredibly convenient and accessible.

2. Time-Saving:

Time is precious, especially for busy individuals juggling work, family, and other responsibilities. Bill Generators Online cut down the time required to create LTA receipts significantly. Instead of spending hours manually calculating expenses and formatting receipts, users can generate accurate receipts within minutes. This time-saving feature allows employees to focus their energy on more critical tasks, boosting productivity and efficiency.

3. Accuracy:

Manual calculations are prone to errors, leading to discrepancies in LTA receipts and potential issues during reimbursement or tax claims. Bill Generators Online mitigate this risk

by automating the calculation process. These platforms use algorithms to accurately calculate travel expenses based on the information provided by users, ensuring that the generated receipts are error-free and reliable.

4. Accessibility:

Accessibility is vital in today’s digital world. Bill Generators Online allow users to access their receipts from any device with an internet connection. Whether you’re using a computer, smartphone, or tablet, you can easily retrieve your LTA receipts whenever needed. This accessibility ensures that significant documentation is always available, regardless of location.

5. Cost-Effectiveness:

Traditional methods of generating receipts, such as purchasing expensive software or hiring professional services, can be costly. Bill Generators Online offer a cost-effective alternative. Many online platforms provide their services for free or at a nominal cost, making them accessible to individuals and organisations of all sizes. By eliminating the need for expensive software licenses or professional assistance, online bill generators help save money while streamlining expense management processes.

How to Create an LTA Receipt?

Creating an LTA (Leave Travel Allowance) receipt is straightforward when using an online bill generator like billgenerator.online. Here’s a detailed guide on how to create an LTA receipt:

1. Visit billgenerator.online: Open your web browser and navigate to the website billgenerator.online.

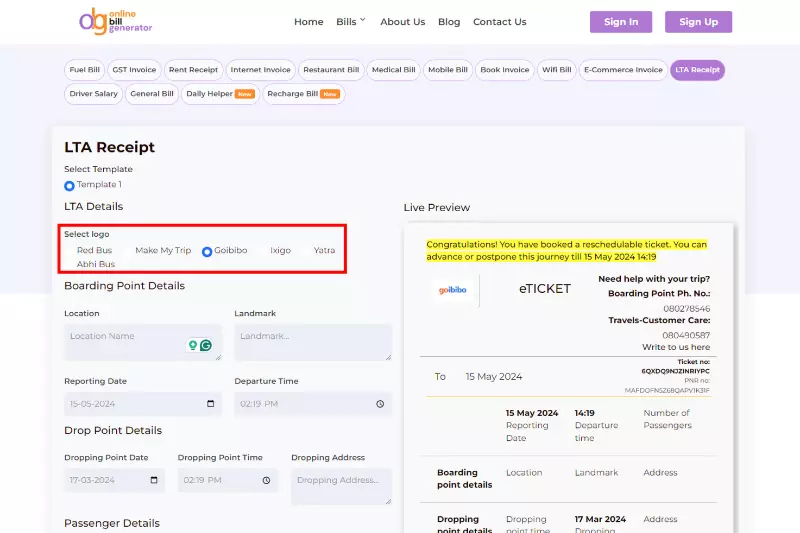

2. Click on LTA Receipt: On the homepage, locate and click on the option to generate an LTA receipt. This action will redirect you to the LTA receipt generation page.

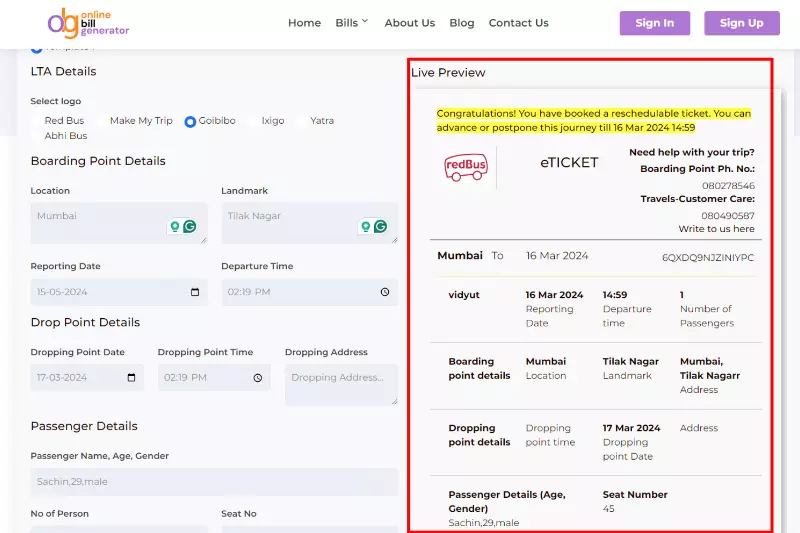

3. Select Logo: Choose the logo that you want to include on your LTA receipt. This could be your company logo or any other relevant logo you prefer.

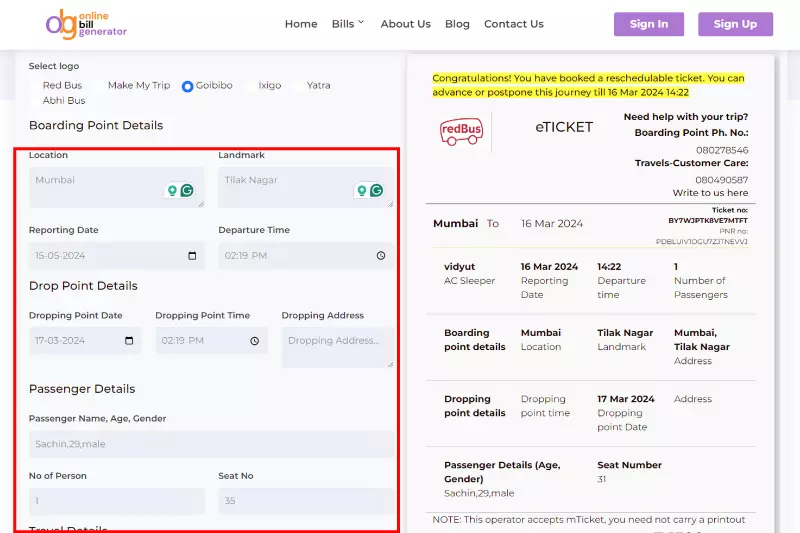

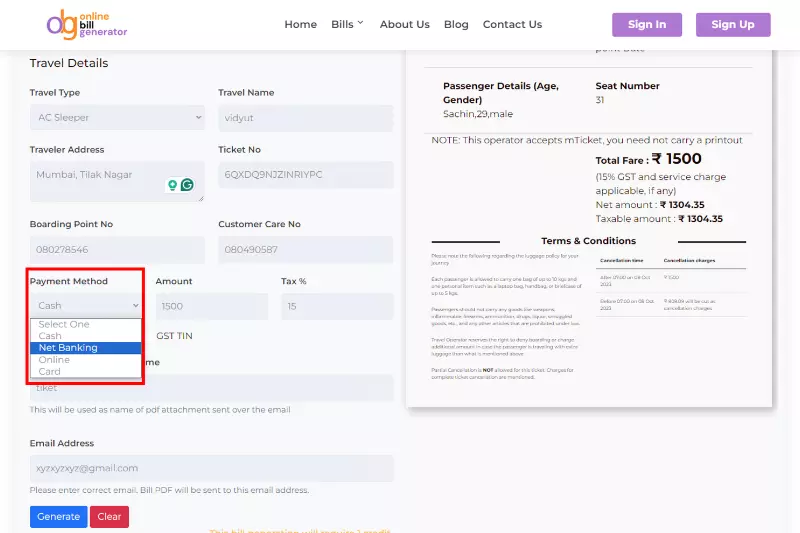

4. Fill All Necessary Details: Fill in all the required details, such as the location of departure, departure time and date, destination details, passenger details, seat number, ticket number, payment amount, and tax details. Ensure accuracy and completeness when filling out these fields.

5. Select Payment Mode and Tax: Select the payment mode for the travel expenses incurred and specify any applicable tax details as required.

6. Preview the Receipt on the Right Side: Once all necessary details are filled in, a preview of the LTA receipt will be displayed on the right side of the page. Take a moment to review the receipt and ensure all information is accurate and correctly formatted.

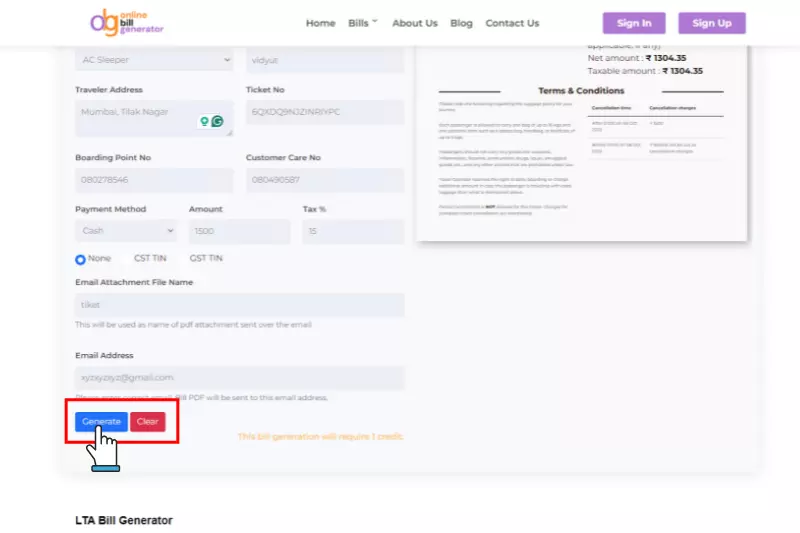

7. Click on Generate: After reviewing the preview, click on the “Generate” button. The online bill generator will automatically process the information and generate your LTA receipt in PDF format.

By following these steps, you can efficiently create an LTA receipt using the online bill generator, simplifying the process and ensuring accuracy in documentation for your travel expenses.

The Importance of Using a Proper LTA Bill Receipt Format

A proper LTA (Leave Travel Allowance) bill receipt format is essential for employees and employers. Firstly, it ensures clarity and transparency in documenting travel expenses, which is crucial for accurate reimbursement and tax claims. With a standardised format, all necessary information, such as travel dates, destination details, and payment amounts, are clearly outlined, reducing the risk of errors or misunderstandings.

Secondly, a proper receipt format facilitates compliance with company policies and regulatory requirements, ensuring consistency and accuracy in expense documentation. This streamlines administrative processes and helps maintain financial transparency and accountability within organisations. A standardised receipt format also enables easy retrieval and reference of travel expense records, providing valuable documentation for auditing purposes or future reference. A proper LTA bill receipt format simplifies expense management, enhances accuracy, and promotes financial integrity for employees and employers.

Why Choose billgenerator.online?

Choosing billgenerator.online offers numerous benefits beyond just LTA receipt generation. Here’s why you should consider this platform:

1. Versatility in Bill Generation:

Apart from LTA receipts, billgenerator.online offers many bill generation facilities. Users can generate bills for various purposes, including fuel bills, GST invoices, rent receipts, restaurant bills, mobile bills, WiFi bills, etc.

2. Convenience and Accessibility:

The platform provides a convenient and accessible solution for generating bills online. Users can access the website from any device with an internet connection, allowing for flexibility in bill generation anytime, anywhere.

3. User-Friendly Interface:

Billgenerator.online features a user-friendly interface that simplifies the bill generation process. The website is designed to be intuitive and easy to navigate, ensuring a seamless experience for users.

4. Time and Cost Savings:

Using Billgenerator.online, users can save both time and costs associated with manual bill generation or hiring professional services. The platform streamlines the process, enabling quick and efficient bill generation at minimal expense.

5. Reliability and Security:

Billgenerator.online prioritises the security and privacy of user data. The platform employs robust security measures to safeguard sensitive information, ensuring a safe and secure environment for bill generation.

6. Wide User Base:

With its diverse bill generation facilities, billgenerator.online caters to a wide user base across different industries and sectors. Whether you’re an individual, small business owner, or large corporation, the platform offers solutions tailored to your needs.

7. Continuous Updates and Improvements:

The platform is continuously updated and improved to enhance user experience and add new features. Users can expect regular updates and enhancements to further improve the functionality and usability of billgenerator.online.

In summary, billgenerator.online is a comprehensive and reliable platform for bill generation, offering users versatility, convenience, customisation options, cost-effectiveness, and security.

Conclusion

Adopting a proper LTA bill receipt format is vital for ensuring accuracy and transparency in documenting travel expenses. This standardised approach simplifies the reimbursement and tax claim process and reduces the risk of errors and misunderstandings. By adhering to a consistent format, individuals and organisations can streamline expense management, enhance financial accountability, and maintain compliance with regulatory requirements. Additionally, a well-structured receipt format is a reliable reference for auditing purposes and facilitates financial analysis.

In conclusion, using a proper LTA bill receipt format cannot be overstated. It is a fundamental aspect of effective expense management, enabling individuals and organisations to operate efficiently, accurately, and consistently. Embracing standardised formats demonstrates a commitment to financial transparency and accountability, ultimately contributing to business operations’ success and credibility.

Frequently Asked Questions (FAQ’s) About LTA Receipt Online

How can I generate a bill?

You can generate a bill online using platforms like billgenerator.online. Visit the website, fill in the required details, such as the type of bill, your information, and the billing details, and then generate the bill.

Can invoices be online?

Yes, invoices can be generated online. Many businesses use online invoicing software or platforms to create and send their clients or customers invoices.

What are the proofs of LTA?

Proofs of LTA typically include documents such as travel tickets, hotel bills, boarding passes, and any other receipts related to travel expenses. These documents indicate your travel and are required for LTA claims. You can create these proofs online using platforms like billgenerator.online for your convenience.

What proof is required for LTA claim?

You must submit proof of travel expenses, such as tickets, hotel bills, and receipts for LTA claims. These documents should show details like travel dates, destination, and mode of transport.

Is LTA deducted from salary?

No, LTA is not deducted from your salary. It’s a component of your salary package that allows you to claim reimbursement for travel expenses incurred during your leave.

What is the LTA limit?

The LTA limit varies depending on your employer’s policies and the provisions of the Income Tax Act. It typically covers travel expenses for up to two trips within a block of four calendar years.

Can LTA be claimed in ITR directly?

You can claim LTA in your Income Tax Return (ITR). Ensure you have proper documentation, including LTA receipts, to support your claim.

How is LTA calculated in salary?

LTA is usually calculated as a percentage of your basic salary. The exact calculation method may vary depending on your employer’s policies.

Can I claim LTA myself?

Yes, you can claim LTA by providing the necessary documentation to your employer or by filing your income tax return. Platforms like billgenerator.online can help you create LTA receipts for your claims.

How do I make a PDF bill?

You can use software like Microsoft Word or Google Docs to make a PDF bill. Create your bill with all the necessary details, then save the document as a PDF file. Alternatively, you can use online platforms like billgenerator.online, where you can instantly fill in the bill details and generate a PDF bill.